On Friday, the AUD strengthened 0.37% against the USD to close at 0.9378, following downbeat non-farm payrolls data from the US.

In economic news, the RBA reported that the foreign reserves surplus in Australia narrowed to A$60.043 billion in August, from previous month’s reserve surplus of A$62.714 billion.

LME Copper prices rose 0.09% or $ 6.0/MT to $ 6973.0/MT. Aluminium prices declined 0.48% or $ 10.0/MT to $ 2075.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.9367, with the AUD trading 0.12% lower from Friday’s close.

Early morning data indicated that in Australia, the ANZ job advertisements climbed 1.5%, on a monthly basis, in August, from previous month’s 0.5% rise.

Meanwhile, data from China, Australia’s biggest trading partner, revealed that trade surplus in China rose to $49.83 billion in August, beating market expectations of $40.0 billion and compared to a trade surplus of $47.30 billion in July. China’s record high surplus was on account of an increase in the exports, while the imports unexpectedly dropped for the month.

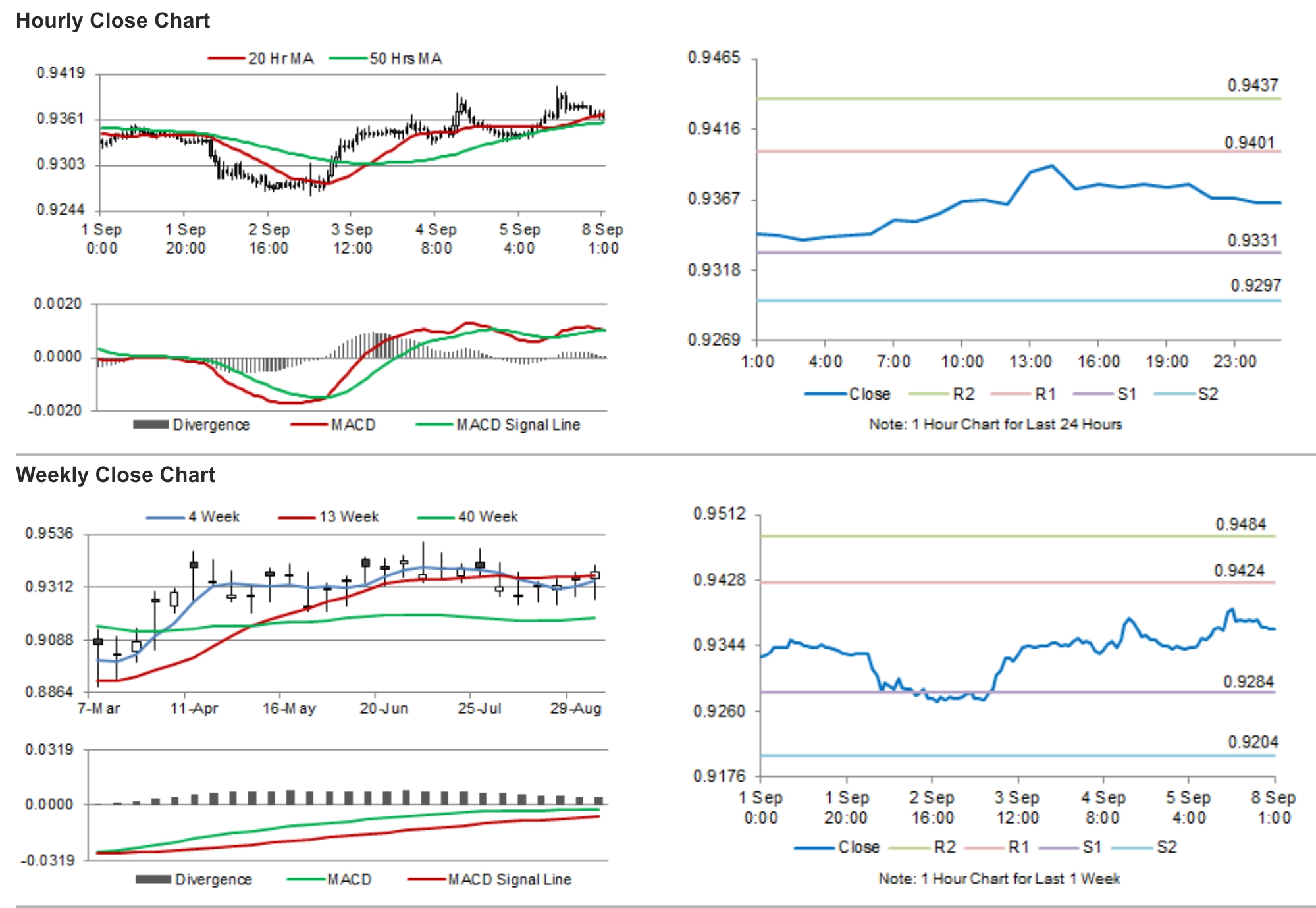

The pair is expected to find support at 0.9334, and a fall through could take it to the next support level of 0.9302. The pair is expected to find its first resistance at 0.9401, and a rise through could take it to the next resistance level of 0.9436.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.