On Friday, the AUD strengthened 0.17% against the USD to close at 0.7812.

LME Copper prices declined 0.93% or $55.0/MT to $5880.5/MT. Aluminium prices declined 0.22% or $4.0/MT to $1794.5/MT.

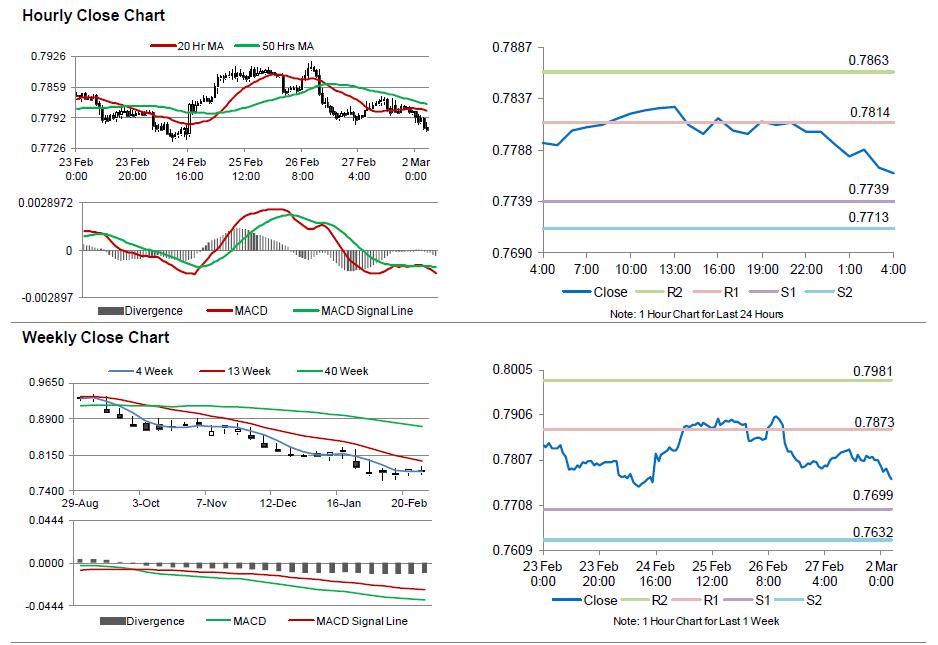

In the Asian session, at GMT0400, the pair is trading at 0.7766, with the AUD trading 0.59% lower from Friday’s close.

Earlier today, data showed that new home sales in Australia rebounded 1.8% on a monthly basis in January, compared to a fall of 1.9% recorded in the preceding month.

Elsewhere, in China, Australia’s biggest trading partner, the HSBC manufacturing PMI surprisingly climbed to a level of 50.7 in February, against market expectations of an unchanged reading of 50.1 registered in January.

Over the weekend, data revealed that Australia’s AiG performance of manufacturing index dropped to a reading of 45.4 in February, following a level of 49.0 recorded in the prior month.

On the other hand, the PBoC lowered its benchmark interest rate for the second time since November, with effect from 01 March, in order to support the nation’s slowing economy.

Meanwhile, in China, the NBS manufacturing PMI surprisingly edged up to a level of 49.9 in February, but still remained below the expansion mark and compared to January’s 28-month low level of 49.8. Markets were expecting the index to drop to 49. Meanwhile, the nation’s non-manufacturing PMI advanced to a level of 53.9, from prior month’s reading of 53.7.

The pair is expected to find support at 0.7739, and a fall through could take it to the next support level of 0.7713. The pair is expected to find its first resistance at 0.7814, and a rise through could take it to the next resistance level of 0.7863.

Going forward, the RBA’s interest rate decision would be closely watched by the market participants, scheduled tomorrow, as it is highly anticipated that the central bank may cut its interest rate.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.