For the 24 hours to 23:00 GMT, the AUD rose 0.26% against the USD and closed at 0.7122.

LME Copper prices declined 0.73% or $33.0/MT to $4474.0/MT. Aluminium prices declined 0.33% or $5.0/MT to $1494.0/MT.

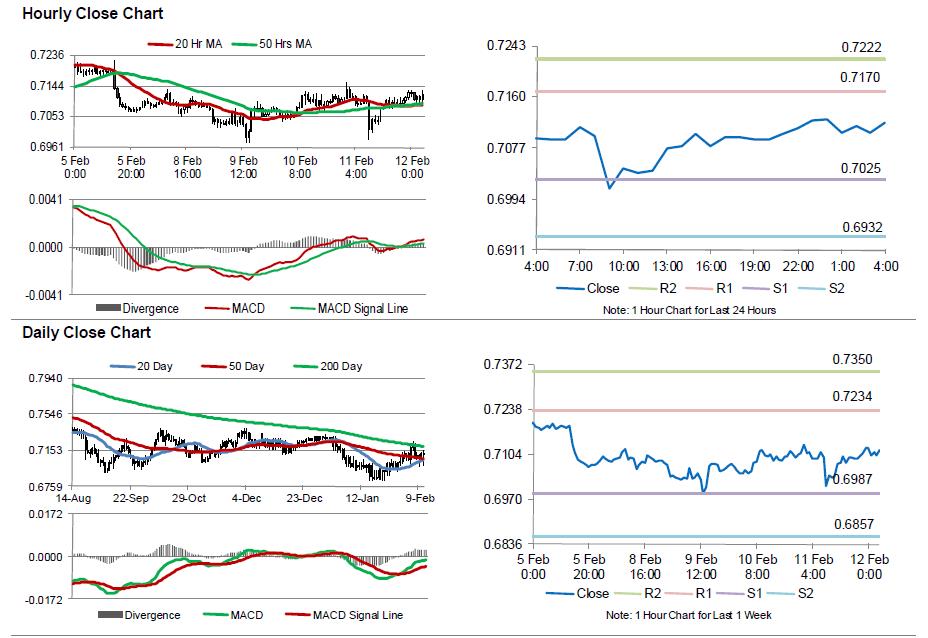

In the Asian session, at GMT0400, the pair is trading at 0.7118, with the AUD trading 0.06% lower from yesterday’s close.

Earlier today, the RBA Governor, Glenn Stevens, in his testimony highlighted that the central bank has room for further easing if needed on the back of controlled inflation in Australia. He added that surprising strength in the domestic labour market could be for short-term and the fall in mining investment spending would last longer than at least a year. He also downplayed worries about the health of the Australia’s banks, as their exposure to debt in the oil and gas sector was quite minimal.

Early this morning, data showed that Australia’s home loans unexpectedly fell by 2.6% in December, from a revised reading of 1.9% in the preceding month and compared to investor expectations for a gain of 3.0%.

The pair is expected to find support at 0.7025, and a fall through could take it to the next support level of 0.6932. The pair is expected to find its first resistance at 0.717, and a rise through could take it to the next resistance level of 0.7222.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.