For the 24 hours to 23:00 GMT, the AUD rose 0.47% against the USD and closed at 0.7211.

LME Copper prices declined 1.1% or $68.0/MT to $5951.0/MT. Aluminium prices fell 1.4% or $28.5/MT to $2083.5/MT.

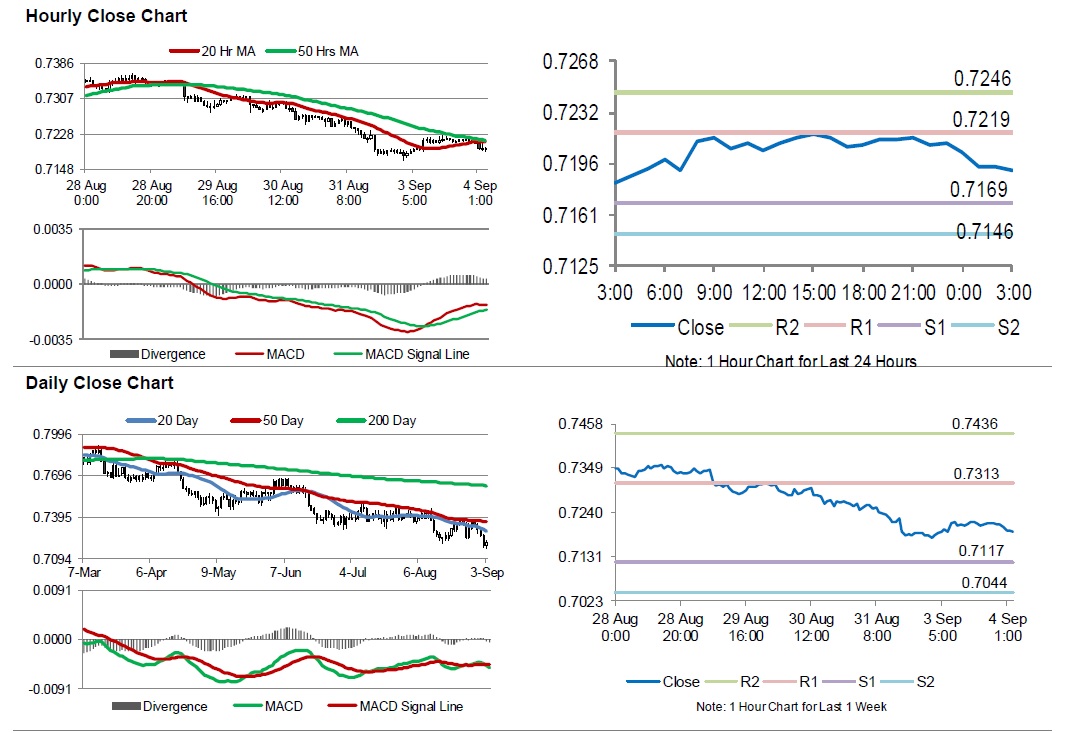

In the Asian session, at GMT0300, the pair is trading at 0.7191, with the AUD trading 0.28% lower against the USD from yesterday’s close.

Earlier today, Australia’s seasonally adjusted current account deficit expanded to A$13.5 billion in 2Q 2018, compared to a revised deficit of A$11.7 billion in the previous quarter. Market anticipation was for the country’s current account deficit to stand at A$11.0 billion.

Separately, the Reserve Bank of Australia (RBA), in its September monetary policy decision, kept its benchmark interest rate unchanged at 1.50%, for a 25th consecutive month.

The pair is expected to find support at 0.7169, and a fall through could take it to the next support level of 0.7146. The pair is expected to find its first resistance at 0.7219, and a rise through could take it to the next resistance level of 0.7246.

Looking ahead, market participants would keep a close watch on Australia’s gross domestic product (GDP) for 2Q and the AIG performance of service index for August, slated to release overnight.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.