For the 24 hours to 23:00 GMT, the AUD strengthened 1.10% against the USD to close at 0.7449.

LME Copper prices declined 2.49% or $117.0/MT to $4589.0/MT. Aluminium prices declined 0.45% or $7.0/MT to $1541.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.744, with the AUD trading 0.12% lower against the US Dollar from yesterday’s close.

Early this morning, data showed that Australia’s home loan approvals rose less-than-expected by 1.7% in April, following a 0.7% decline in the previous month.

Elsewhere, in China, Australia’s largest trading partner, trade surplus widened to a level of CNY324.8 billion in May, from a level of CNY298.0 billion in the previous month. Meanwhile, imports surprisingly rebounded by 5.1%, while exports rose less-than-expected by 1.2% on an annual basis in May.

Separately, the World Bank kept China’s growth forecast unchanged at 6.7% for this year and expects growth to slow further to 6.3% by 2018, as the world’s second-largest economy rebalances away from exports to a more consumer-driven growth model.

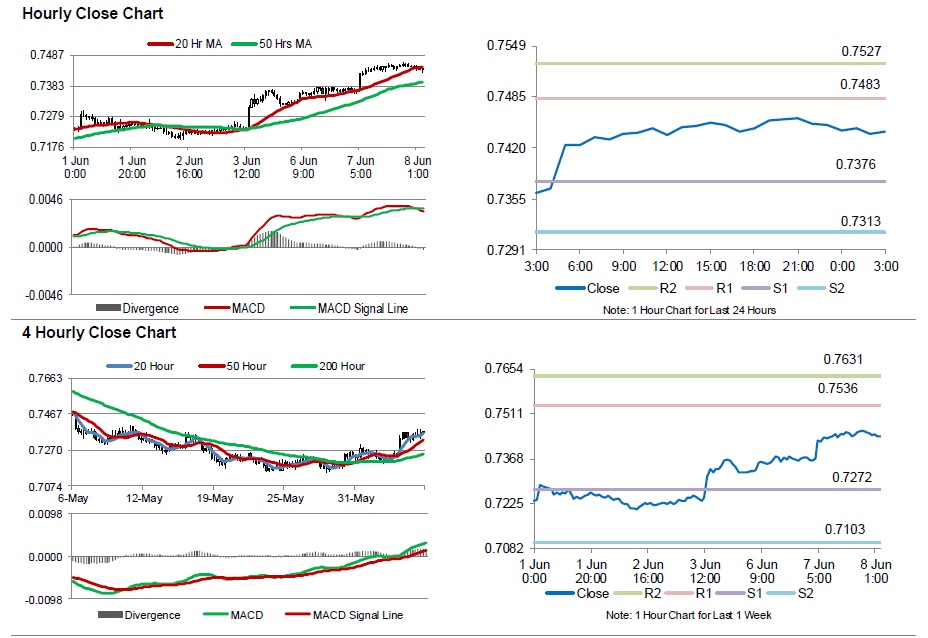

The pair is expected to find support at 0.7376, and a fall through could take it to the next support level of 0.7313. The pair is expected to find its first resistance at 0.7483, and a rise through could take it to the next resistance level of 0.7527.

Going ahead, investors will look forward to the release of China’s consumer price index data for May, due in the early hours tomorrow.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.