For the 24 hours to 23:00 GMT, the AUD strengthened 0.25% against the USD to close at 0.9391.

LME Copper prices rose 1.0% or $71.0/MT to $ 7060.5/MT. Aluminium prices rose 1.6% or $32.5/MT to $ 2020.5/MT.

In the Asian session, at GMT0300, the pair is trading at 0.9435, with the AUD trading 0.47% higher from yesterday’s close, after data released indicated that the inflation on an annual basis in Australia rose at its fastest pace in four years. The Australian Bureau of Statistics reported that consumer prices jumped 3.0% on a yearly basis in June, at par with market expectations. In the prior quarter, consumer prices had registered a rise of 2.9%. Separately, internet skilled vacancies in Australia registered a rise of 1.6% in June, from a revised rise of 1.8% in the prior month.

Earlier today, RBA Deputy Governor Philip Lowe, at the RMB Internationalisation Round Table in Sydney, revealed that the nation has shifted its foreign currency portfolio towards the Chinese Yuan and at present it has around 3% invested in that currency.

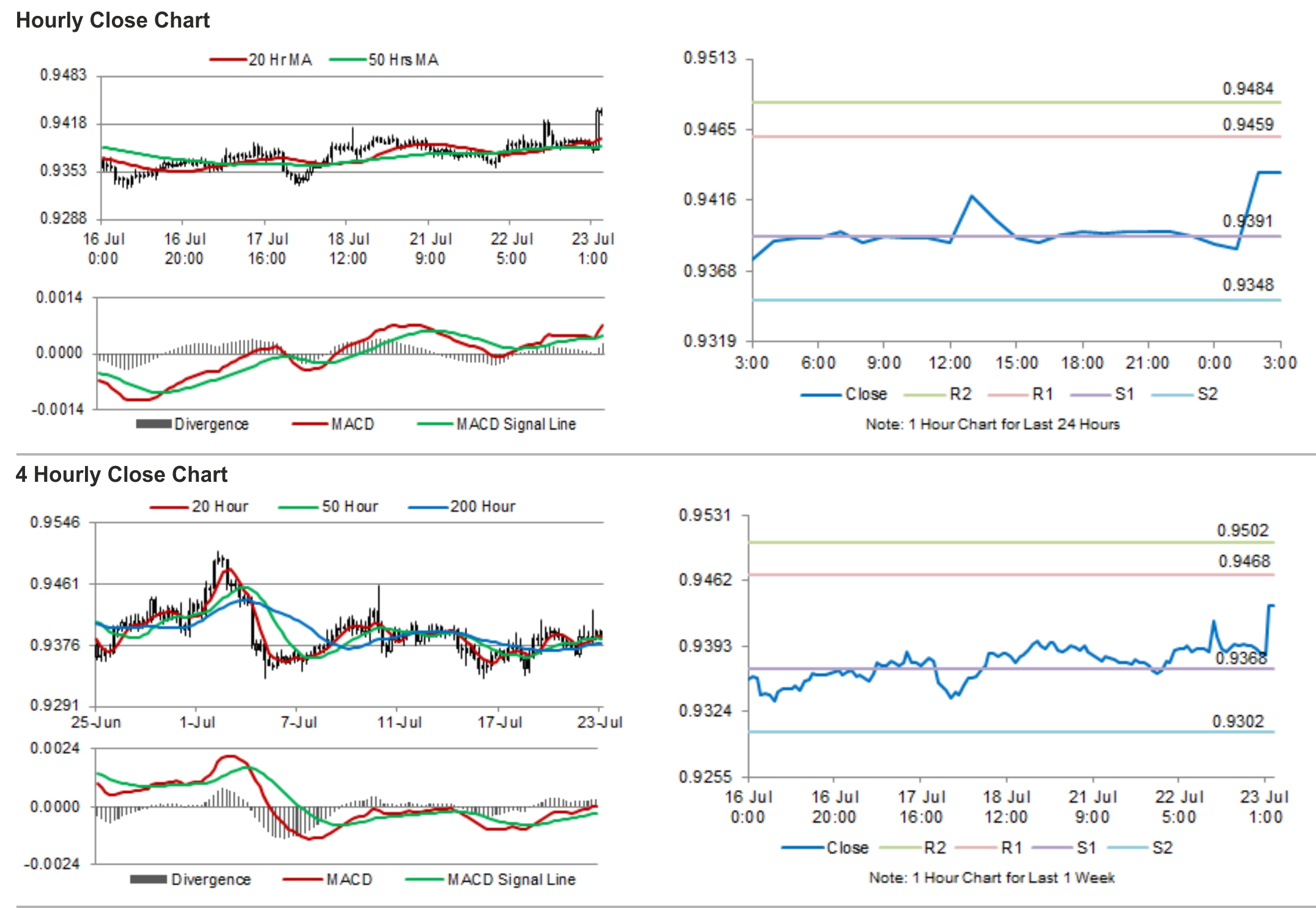

The pair is expected to find support at 0.9391, and a fall through could take it to the next support level of 0.9348. The pair is expected to find its first resistance at 0.9459, and a rise through could take it to the next resistance level of 0.9484.

Trading trends in the pair today are expected to be determined by external factors, amid lack of economic data from Australia.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.