For the 24 hours to 23:00 GMT, the AUD weakened/ strengthened x.xx% against the USD to close at x.xxxx.

LME Copper prices declined 0.6% or $45.0/MT to $7051.0/MT. Aluminium prices traded marginally higher or $0.5/MT to $2082.5/MT.

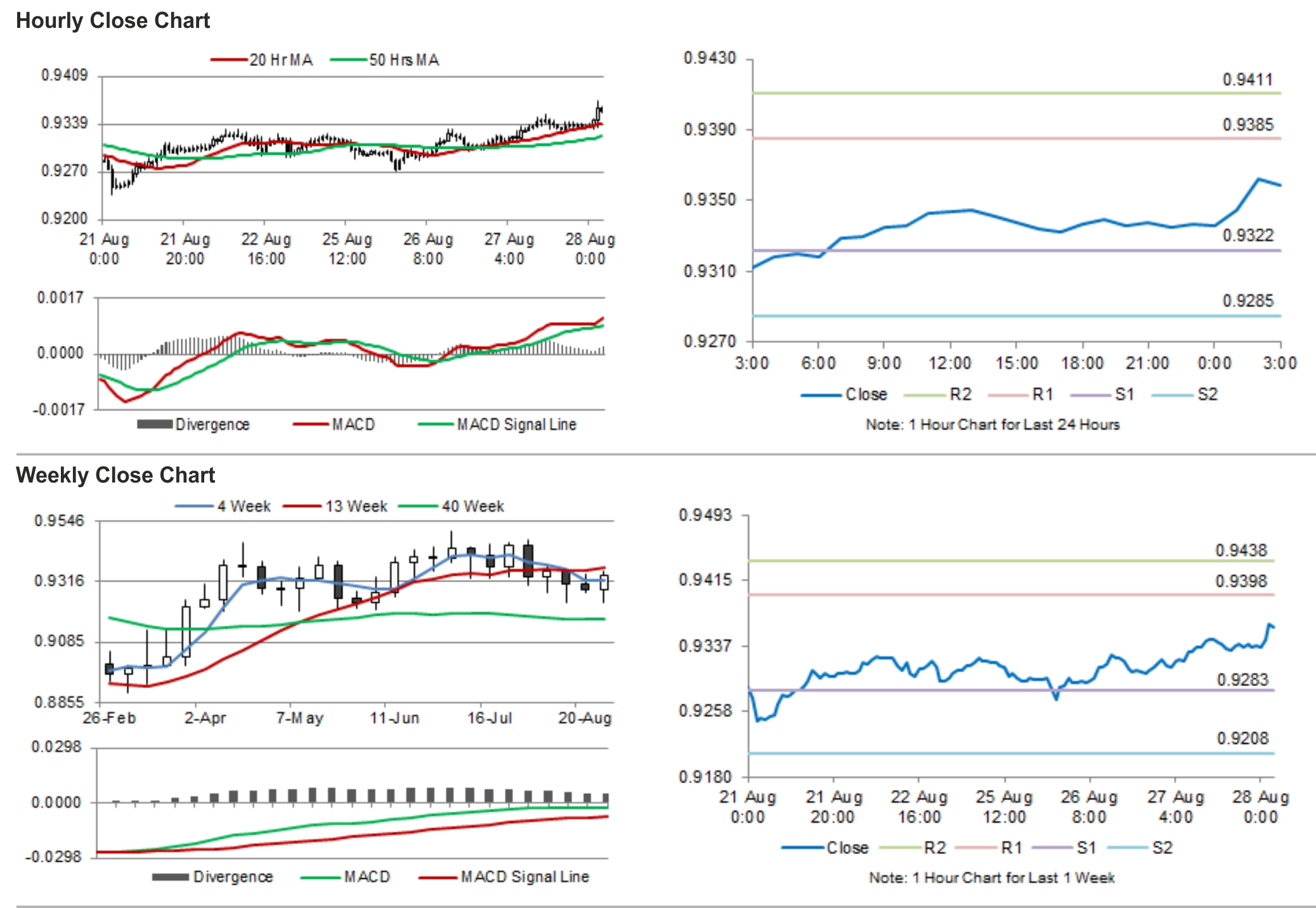

In the Asian session, at GMT0300, the pair is trading at 0.9359, with the AUD trading 0.24% higher from yesterday’s close.

In China, Australia’s biggest trading partner, the industrial profits increased 13.5% in July, on an annual basis, down from a rise of 17.9% registered in the previous month.

Elsewhere, new home sales in Australia fell 5.7% in July, on a monthly basis, compared to a rise of 1.2% recorded in the previous month. Meanwhile, the seasonally adjusted private capital expenditure in Australia unexpectedly advanced 1.1% in 2Q 2014, on a QoQ basis, compared to a revised drop of 2.5% in the previous quarter. Markets were anticipating private capital expenditure to decline 0.9%.

The pair is expected to find support at 0.9322, and a fall through could take it to the next support level of 0.9285. The pair is expected to find its first resistance at 0.9385, and a rise through could take it to the next resistance level of 0.9411.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.