For the 24 hours to 23:00 GMT, the AUD declined 0.31% against the USD and closed at 0.7100.

LME Copper prices rose 0.32% or $ 14.5/MT to $ 4488.5/MT. Aluminium prices rose 0.33% or $ 5.0/MT to $ 1499.0/MT.

In the Asian session, at GMT0400, the pair is trading at 0.7158, with the AUD trading 0.82% higher from Friday’s close.

Early this morning, in China, Australia’s largest trading partner, data indicated that trade surplus rose more-than-expected to $63.29 billion in January, whereas markets expected it to rose to $60.60 billion and compared to a surplus of $60.09 billion in the previous month. Meanwhile, overseas shipments eased more than expected by 11.2% YoY in January, compared to a drop of 1.4% recorded in December while imports slipped 18.8% YoY in January, higher than market expected drop of 3.6%, indicating a negative for the Chinese economy.

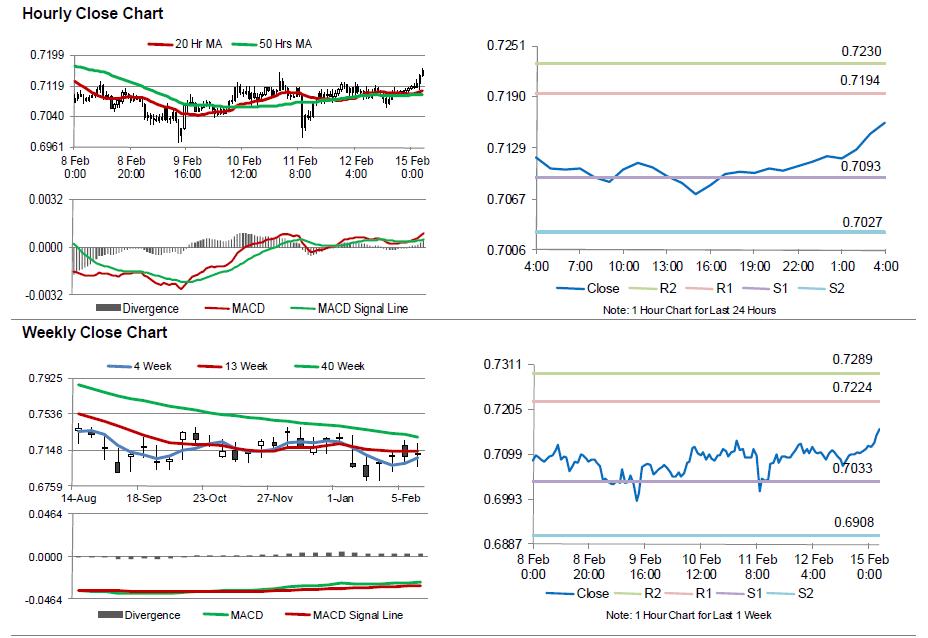

The pair is expected to find support at 0.7093, and a fall through could take it to the next support level of 0.7027. The pair is expected to find its first resistance at 0.7194, and a rise through could take it to the next resistance level of 0.723.

Going ahead, market participants will keep a close watch on Australia’s Westpac leading index data for January, slated to release overnight.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.