For the 24 hours to 23:00 GMT, the AUD weakened 0.64% against the USD to close at 0.8701, after Australia’s CB leading index dropped 0.3% in September, compared to a revised fall of 0.1% in August.

LME Copper prices rose 0.85% or $57.0/MT to $6752.0/MT. Aluminium prices rose 1.44% or $29.0/MT to $2049.5/MT.

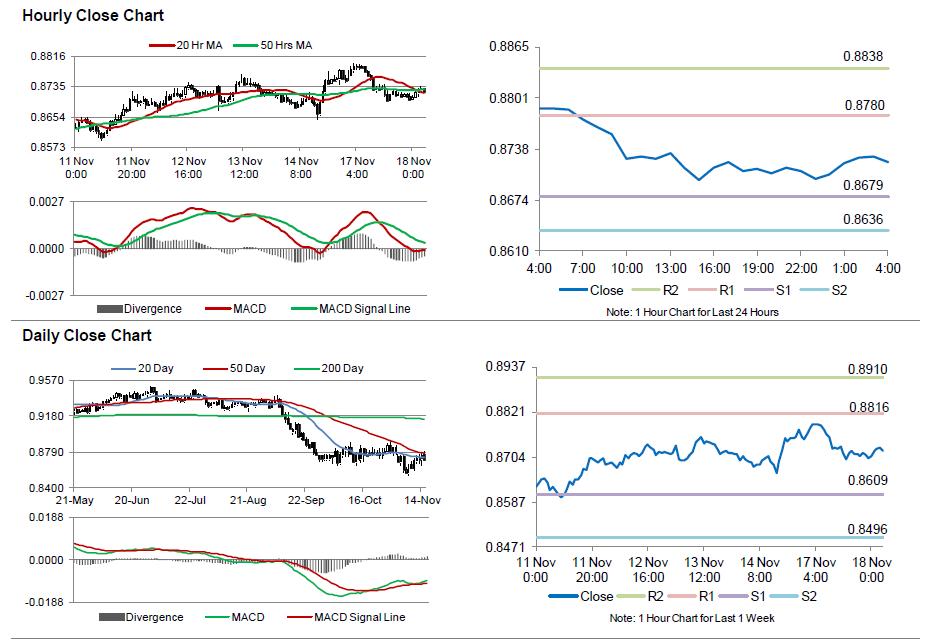

In the Asian session, at GMT0400, the pair is trading at 0.8721, with the AUD trading 0.23% higher from yesterday’s close.

Earlier today, the RBA minutes from its latest monetary policy meeting reported that board members were of the view that the nation’s economy was likely to grow at a moderate pace, before gradually picking up to an above-trend pace towards the end of 2016. Also, the central bank expressed concerns over the elevated value of the Aussie and indicated that the nation’s mining-led growth is weighing on the Australian economy.

Elsewhere in China, Australia’s biggest trading partner, actual FDI climbed 1.30% in October, compared to an advance of 1.9% registered in the preceding month. Meanwhile, house price index in China eased 2.60% on a YoY basis, in October, following a drop of 1.30% registered in the prior month.

The pair is expected to find support at 0.8679, and a fall through could take it to the next support level of 0.8636. The pair is expected to find its first resistance at 0.8780, and a rise through could take it to the next resistance level of 0.8838.

Trading trends in the AUD today would be determined by the RBA Governor, Glenn Stevens’ speech, scheduled shortly.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.