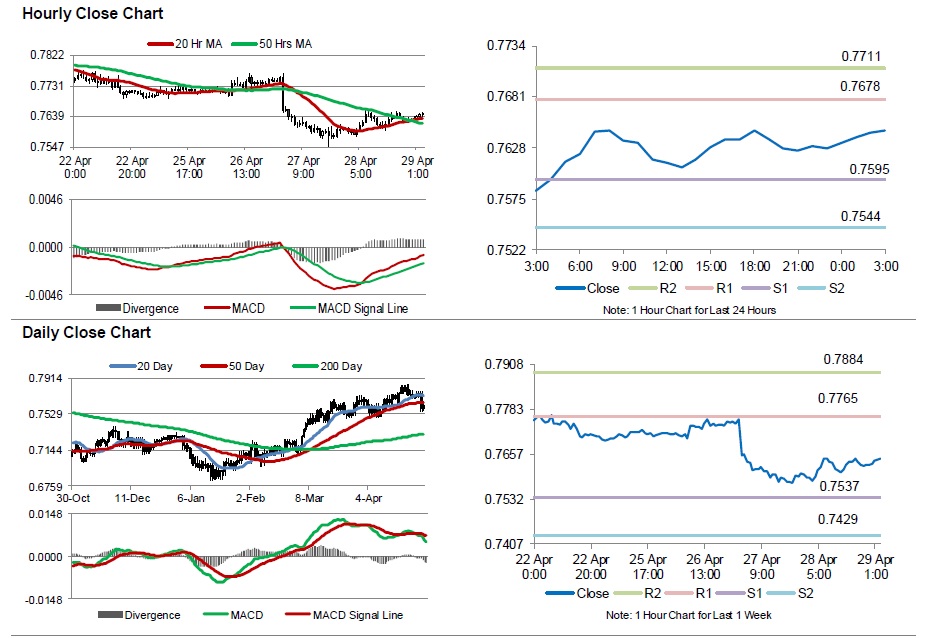

For the 24 hours to 23:00 GMT, the AUD strengthened 0.32% against the USD to close at 0.7627.

LME Copper prices declined 0.40% or $19.5/MT to $4912.5/MT. Aluminium prices rose 0.40% or $6.5/MT to $1649.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7645, with the AUD trading 0.24% higher from yesterday’s close.

Early this morning, data showed that Australia’s private sector credit rose less-than-anticipated by 0.4% MoM in March, following a 0.6% rise in the previous month. Investors had expected it to advance by 0.5%. Additionally, the nation’s producer price index (PPI) declined by 0.2% QoQ in 1Q 2016, further raising the prospect of a rate cut by the Reserve Bank of Australia (RBA) at its meeting next week. The PPI had climbed 0.3% in the previous quarter.

The pair is expected to find support at 0.7595, and a fall through could take it to the next support level of 0.7544. The pair is expected to find its first resistance at 0.7678, and a rise through could take it to the next resistance level of 0.7711.

Going ahead, investors will look forward to the RBA interest rate decision, along with Australia’s retail sales, trade balance, and the AiG performance of manufacturing and service indices data, all scheduled next week.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.