On Friday, the AUD weakened 0.20% against the USD to close at 0.7642.

LME Copper prices declined 0.47% or $28.5/MT to $6088.5/MT. Aluminium prices declined 0.81% or $14.0/MT to $1705.5/MT.

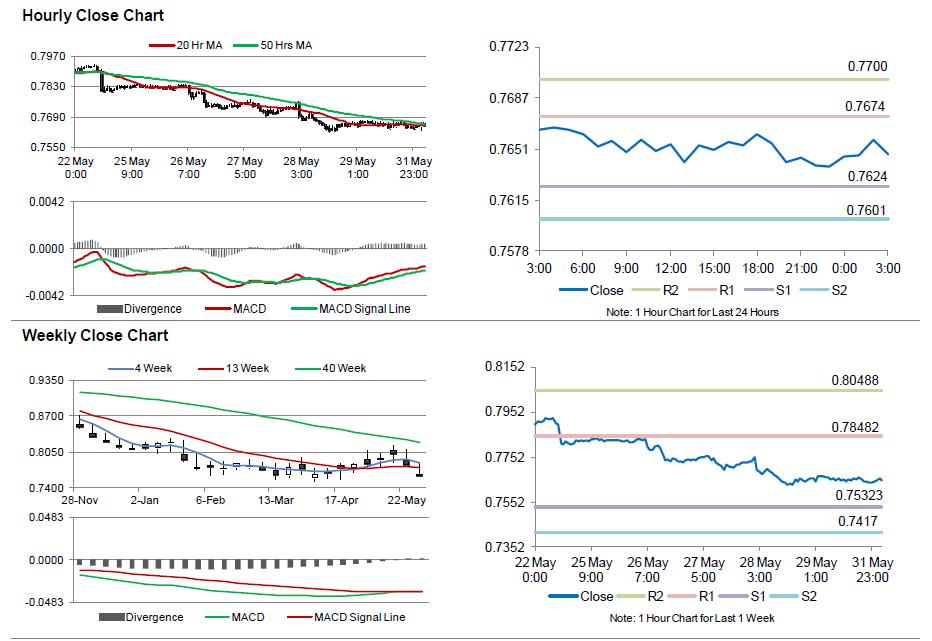

In the Asian session, at GMT0300, the pair is trading at 0.7648, with the AUD trading 0.07% higher from Friday’s close.

Early morning data showed that building approvals in Australia retreated 4.4% MoM in April, higher than an expected drop of 1.8% and following a revised increase of 2.9%.

Elsewhere in China, Australia’s biggest trading partner, the manufacturing PMI edged up to a level of 50.2 in May from 50.1 recorded in April, albeit markets expected it to advance to a level of 50.3. Meanwhile, the nation’s non-manufacturing PMI came in at 53.2 in May, compared to prior month’s reading of 53.4.

On the other hand, China’s HSBC manufacturing PMI showed a slight improvement as the index edged up to 49.1 but remained in the contraction territory for the third consecutive month in May.

Overnight data indicated that Australia’s AiG performance of manufacturing index jumped to a reading of 52.3 in May, following a level of 48.0 in April.

The pair is expected to find support at 0.7624, and a fall through could take it to the next support level of 0.7601. The pair is expected to find its first resistance at 0.7674, and a rise through could take it to the next resistance level of 0.7700.

Going forward, the RBA’s interest rate decision, scheduled tomorrow would grab lot of market attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.