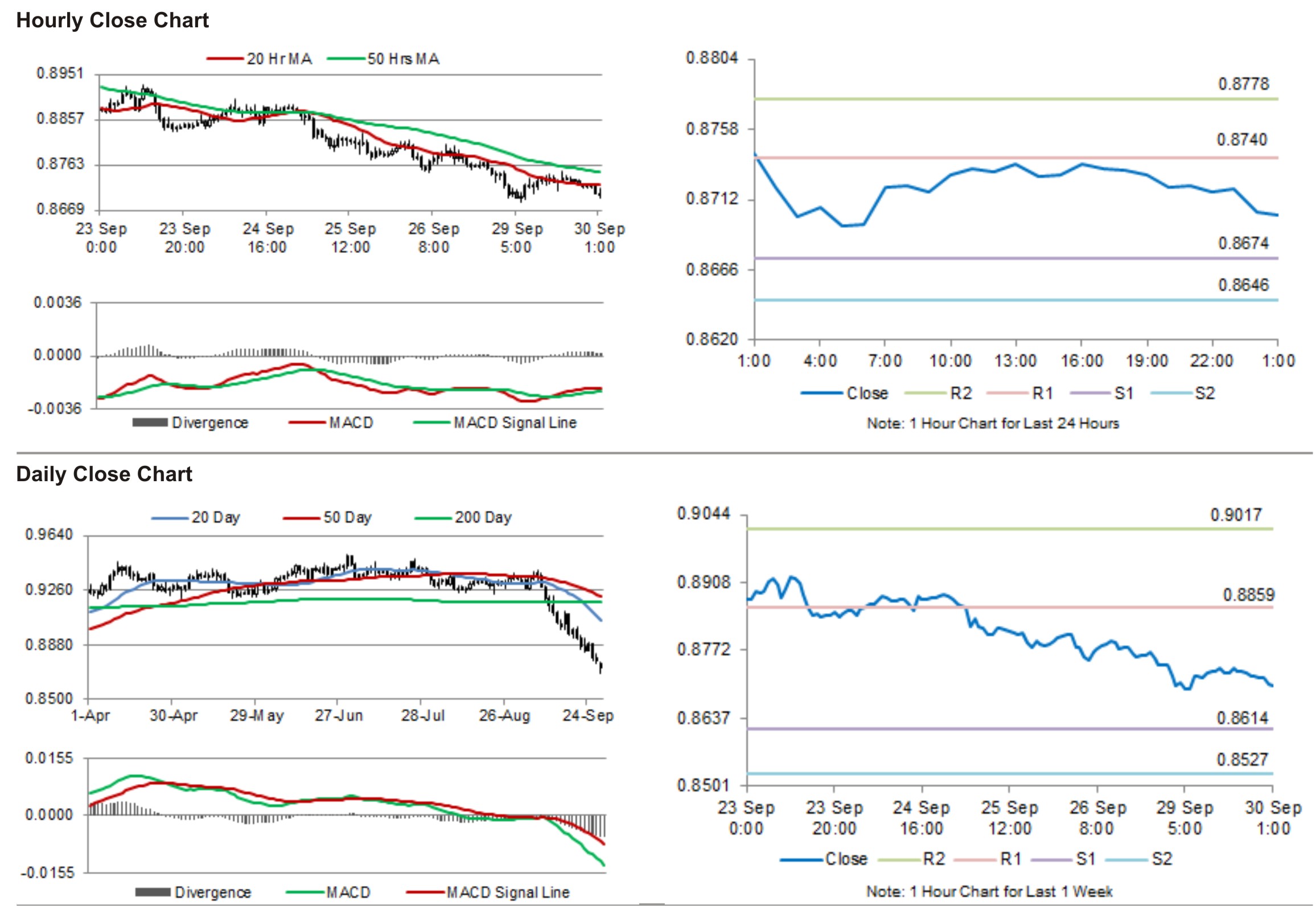

For the 24 hours to 23:00 GMT, the AUD weakened 0.27% against the USD to close at 0.8719.

LME Copper prices declined 0.52% or $35.5/MT to $6735.5/MT. Aluminium prices declined 0.55% or $10.5/MT to $1914.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.8749, with the AUD trading 0.34% higher from yesterday’s close.

Early morning data indicated that the private sector credit in Australia advanced 0.4%, on a monthly basis, in August, lower than market expectations for a rise of 0.5% and compared to 0.4% increase registered in the previous month.

Elsewhere, in China, Australia’s biggest trading partner, the HSBC/Markit PMI came in at 50.2 in September, lower than market expectations for an advance to a reading of 50.5 and compared to a similar level registered in the prior month. Additionally, the nation’s leading index registered a drop to 100.09 in August, down from previous month’s level of 100.2.

The pair is expected to find support at 0.8704, and a fall through could take it to the next support level of 0.8659. The pair is expected to find its first resistance at 0.8774, and a rise through could take it to the next resistance level of 0.8799.

Going further, investors would look forward to AiG performance of manufacturing as well as retail sales data Australia, scheduled in the early hours tomorrow.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.