For the 24 hours to 23:00 GMT, the AUD declined 0.97% against the USD and closed at 0.7534 on Friday.

LME Copper prices rose 5.0% or $281.0/MT to $5900.0/MT. Aluminium prices rose 0.25% or $4.5/MT to $1777.0/MT.

In the Asian session, at GMT0400, the pair is trading at 0.7552, with the AUD trading 0.24% higher against the USD from Friday’s close.

Early morning data revealed that, in China, Australia’s largest trading partner, industrial production advanced less-than-expected by 6.1% YoY in October, suggesting that growth in the world’s second-biggest economy remains sluggish despite emerging signs of stability. Industrial production recorded a similar rise in the previous month whereas markets expected it to rise by 6.2%. Further, the nation’s retail sales climbed less-than-forecasted by 10.0% on an annual basis in October, while market expected it to rise by 10.7%, in line with previous month’s reading.

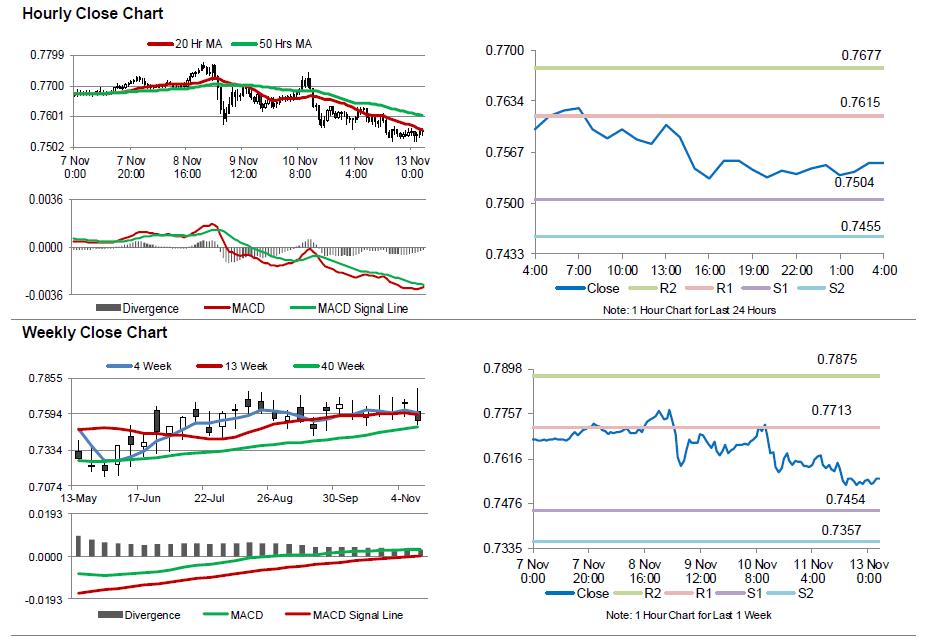

The pair is expected to find support at 0.7504, and a fall through could take it to the next support level of 0.7455. The pair is expected to find its first resistance at 0.7615, and a rise through could take it to the next resistance level of 0.7677.

Moving ahead, investors would focus on Reserve Bank of Australia’s recent meeting minutes, scheduled to release overnight.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.