On Friday, the AUD strengthened 0.90% against the USD to close at 0.8638.

In economic news, Australia’s foreign exchange reserves narrowed to A$53.6 billion in October, compared to a reading of A$60.9 billion registered in the previous month.

LME Copper prices rose 0.59% or $39.5/MT to $6720.5/MT. Aluminium prices rose 1.22% or $25.0/MT to $2077.0/MT.

In the Asian session, at GMT0400, the pair is trading at 0.8675, with the AUD trading 0.43% higher from Friday’s close.

Early morning data indicated that, home loans in Australia dropped 0.7% in September, less than market expectations for a 0.4% drop and after easing 0.9% in August. Meanwhile, the nation’s investment lending rebounded 3.7% in September, after registering a revised rise of 0.7% in August.

Elsewhere, in China, Australia’s biggest trading partner, monthly consumer prices stagnated in October, after registering a rise of 0.5% in September, while markets were expecting consumer prices to rise 0.1%. Additionally, the nation’s producer price index dropped 2.2% on an annual basis in October, higher than market expected drop of 2.0%.

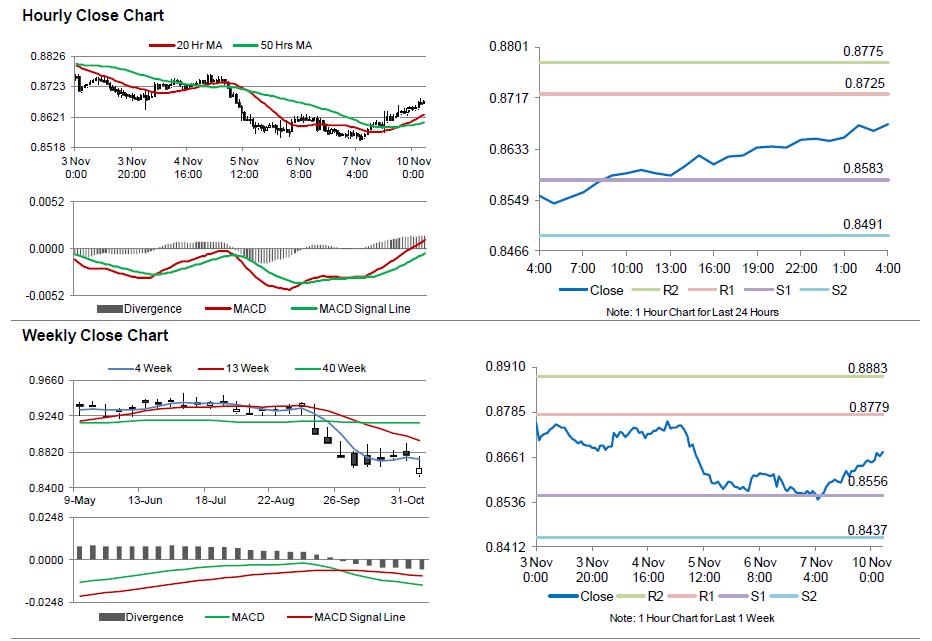

The pair is expected to find support at 0.8583, and a fall through could take it to the next support level of 0.8491. The pair is expected to find its first resistance at 0.8725, and a rise through could take it to the next resistance level of 0.8775.

Going forward, market participants look forward to Australia’s house price and the NAB’s business confidence indices data, scheduled in the early hours tomorrow.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.