For the 24 hours to 23:00 GMT, the AUD strengthened 0.59% against the USD to close at 0.7358.

LME Copper prices rose 0.30% or $16.0/MT to $5335.0/MT. Aluminium prices rose 0.03% or $0.5/MT to $1607.5/MT.

Yesterday, the RBA Deputy Governor, Philip Lowe, expressed optimism over the nation’s economic fundamentals and restated that a weaker Australian Dollar has helped the nation’s economy to transition out from the boom in mining investment.

In the Asian session, at GMT0300, the pair is trading at 0.7303, with the AUD trading 0.74% lower from yesterday’s close.

Overnight data showed that Australia’s ANZ-Roy Morgan consumer confidence index attainted a level of 115.6 for the week ended 11 October, reaching its 15-week high, from a reading of 110.0 in the previous week.

Early morning data showed that the country’s NAB business confidence index rebounded to 5 points in September, from 1 point in August, as appointment of the nation’s new Prime Minister, Malcolm Turnbull, helped resolve uncertainties about the government’s future.

Elsewhere, in China, Australia’s largest trading partner trade surplus rose more-than-expected to CNY376.2 billion in September, compared to CNY368.0 billion in August.

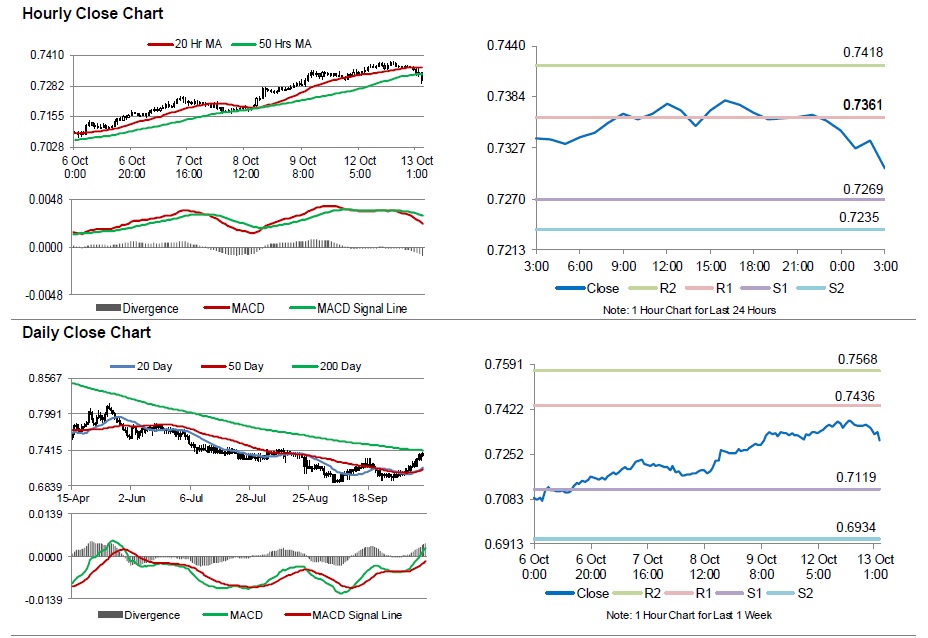

The pair is expected to find support at 0.7269, and a fall through could take it to the next support level of 0.7235. The pair is expected to find its first resistance at 0.7361, and a rise through could take it to the next resistance level of 0.7418.

Going ahead, investors will look forward to Australia’s Westpac consumer confidence index data for October, scheduled to be released overnight.

The currency pair is trading below its 20 Hr moving average and is showing convergence with its 50 Hr moving average.