For the 24 hours to 23:00 GMT, the AUD rose 0.44% against the USD and closed at 0.6990.

LME Copper prices declined 0.33% or $14.5/MT to $4365.5/MT. Aluminium prices rose 1.72% or $25.0/MT to $1478.0/MT.

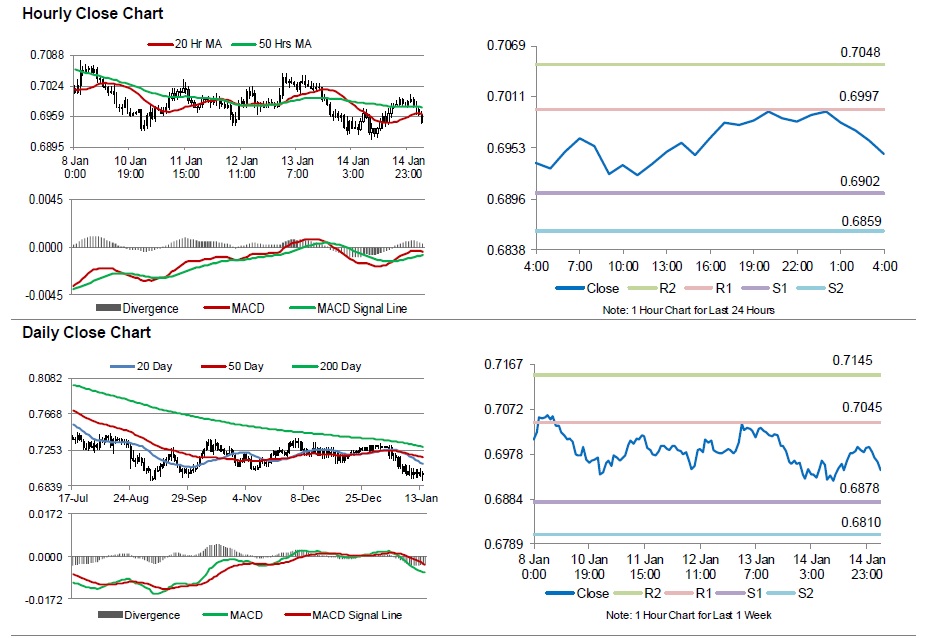

In the Asian session, at GMT0400, the pair is trading at 0.6946, with the AUD trading 0.64% lower from yesterday’s close.

Early this morning data showed that, Australia’s new home loan approvals rose more than expected by 1.8% in November, compared to market expectations of a fall of 0.5% and following a revised drop of 0.3% in the previous month.

Separately, in China, Australia’s largest trading partner, aggregate financing advanced more than expected to a level of CNY1820.0 billion in December, jumping 78% between November and December and the most since June. Meanwhile, markets expected it to advance to a level of CNY1150.0 billion, compared to a revised reading of CNY1018.1 billion in the previous month. On the other hand, the nation’s new Yuan loans increased less than expected to a level of CNY597.8 billion in December while markets expected it to increase to a level of CNY700.0 billion and compared to a reading of CNY708.9 billion in the previous month.

The pair is expected to find support at 0.6902, and a fall through could take it to the next support level of 0.6859. The pair is expected to find its first resistance at 0.6997, and a rise through could take it to the next resistance level of 0.7048.

Amid no macroeconomic releases in Australia today, trading trend in the Aussie is expected to be determined by global macroeconomic news.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.