For the 24 hours to 23:00 GMT, the AUD strengthened 0.21% against the USD to close at 0.8719.

Yesterday, the RBA Governor, Glenn Stevens’ stated that the Australian economy was expected to grow moderately and there was plenty of spare capacity in the economy as mining investment slows down. He further indicated that interest rates in the nation would remain low for some more time.

LME Copper prices declined 1.01% or $68.0/MT to $6684.0/MT. Aluminium prices declined 1.66% or $34.0/MT to $2015.5/MT.

In the Asian session, at GMT0400, the pair is trading at 0.8668, with the AUD trading 0.58% lower from yesterday’s close.

Earlier today, data from Australia showed that the nation’s internet skilled vacancies remained flat at 0.5%, on a MoM basis in October.

Overnight data indicated that, Australia’s Westpac leading index rose 0.03% on a monthly basis in October. The index had registered a 0.1% drop in September.

Elsewhere in China, Australia’s biggest trading partner, the MNI business sentiment index jumped to a level of 55.20 in November, up from a level of 51.7 recorded in previous month.

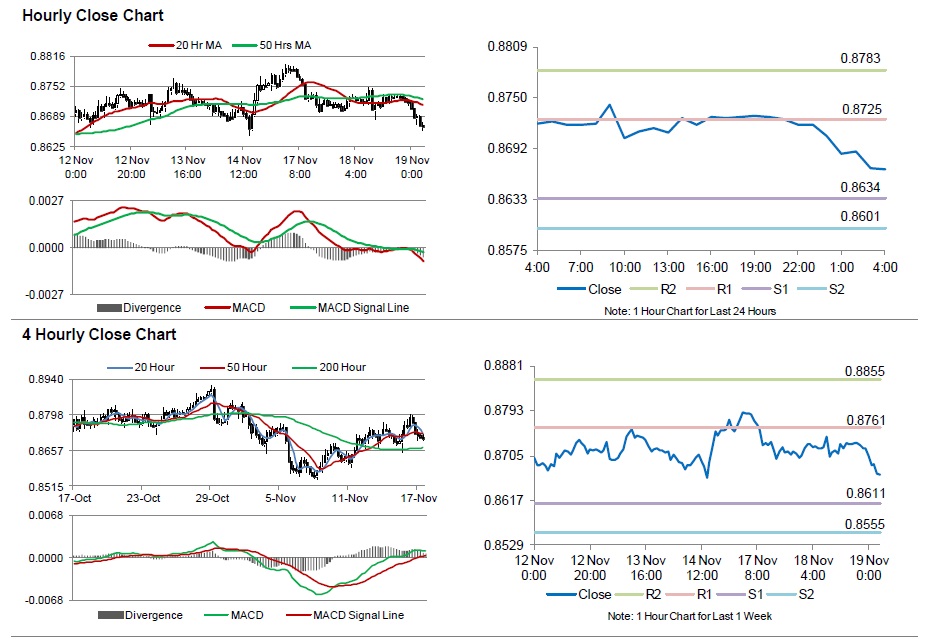

The pair is expected to find support at 0.8634, and a fall through could take it to the next support level of 0.8601. The pair is expected to find its first resistance at 0.8725, and a rise through could take it to the next resistance level of 0.8783.

Amid a light economic calendar from Australia in the rest of the week, investor sentiments would be governed by global macroeconomic news.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.