For the 24 hours to 23:00 GMT, the AUD strengthened 0.21% against the USD to close at 0.7751.

Yesterday’s data showed that in China, Australia’s biggest trading partner, industrial production rose more than expected by 6.1% YoY in May, following an increase of 5.9% recorded in the preceding month. Additionally, the nation’s retail sales climbed 10.1% on an annual basis in May, at par with market expectations, suggesting that China’s economic slowdown may be over.

LME Copper prices declined 2.31% or $139.5/MT to $5906.0/MT. Aluminium prices declined 1.48% or $25.5/MT to $1701.5/MT.

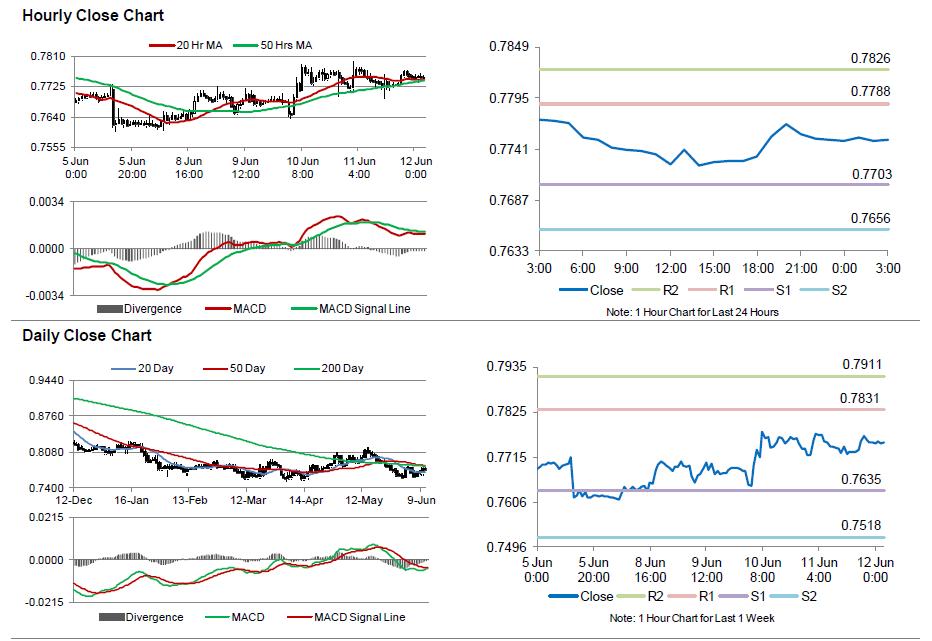

In the Asian session, at GMT0300, the pair is trading at 0.7751, with the AUD trading a tad lower from yesterday’s close.

The pair is expected to find support at 0.7703, and a fall through could take it to the next support level of 0.7656. The pair is expected to find its first resistance at 0.7788, and a rise through could take it to the next resistance level of 0.7826.

Going forward, investors look forward to the release of the RBA minutes from its latest monetary policy meeting scheduled next week.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.