On Friday, the AUD strengthened 0.28% against the USD to close at 0.7310.

LME Copper prices declined 0.40% or $21.0/MT to $5220.0/MT. Aluminium prices declined 0.90% or $14.5/MT to $1594.0/MT.

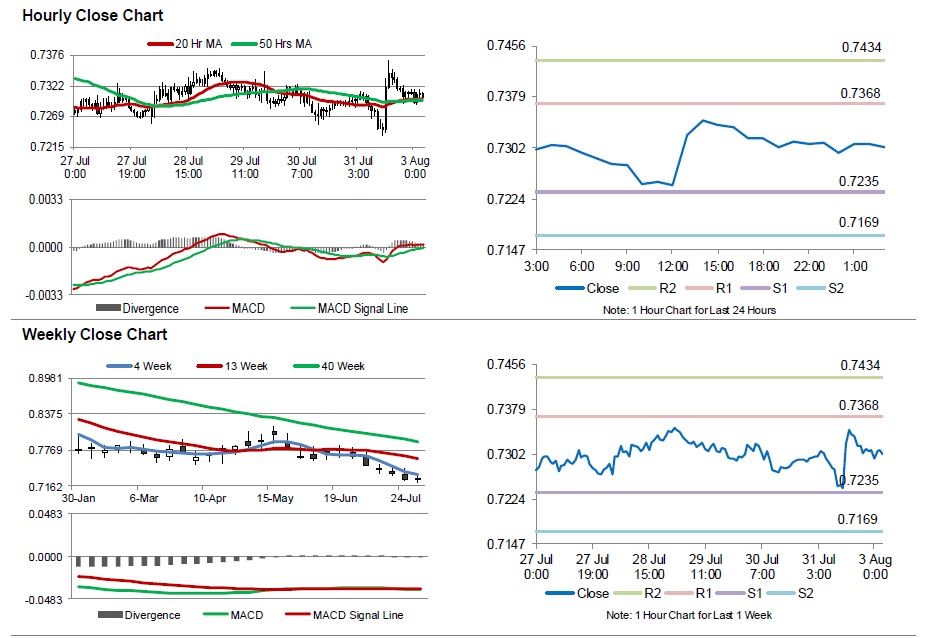

In the Asian session, at GMT0300, the pair is trading at 0.7302, with the AUD trading 0.11% lower from yesterday’s close.

Over the weekend, in China, Australia’s biggest trading partner, the NBS manufacturing PMI fell to a level of 50.00 in July, while the non-manufacturing PMI expanded to 53.9 in in the same month.

Overnight data showed that Australia’s AiG performance of manufacturing index climbed to a level of 50.4 in July, from previous month’s reading of 44.2.

Earlier today, data revealed that new home sales in Australia rebounded 0.5% MoM in June, compared to a drop of 2.3% in the preceding month. In July, the TD Securities Inflation in Australia climbed to 1.60% YoY, after recording a reading of 1.50% in the previous month. Meanwhile, in China, the final print of manufacturing PMI shrank to its lowest reading of 47.8 since November 2011 in July, after recording a level of 48.2 in June. The downbeat manufacturing activity has indicated that the world’s second biggest economy is running out of steam and needs fresh stimulus, as it also faces a stock market rout.

The pair is expected to find support at 0.7235, and a fall through could take it to the next support level of 0.7169. The pair is expected to find its first resistance at 0.7368, and a rise through could take it to the next resistance level of 0.7434.

Moving ahead, the RBA’s crucial interest rate decision scheduled tomorrow would attract lot of attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.