For the 24 hours to 23:00 GMT, the AUD traded marginally lower against the USD to close at 0.8766, amid a broad strengthening in the greenback.

Yesterday, the RBA Governor, Glenn Stevens expressed concerns over Australia’s lending standards and urged banks to carefully monitor the process, as house prices in Australia were already over-heated.

LME Copper prices rose 1.06% or $70.5/MT to $6730.5/MT. Aluminium prices rose 0.41% or $8.0/MT to $1980.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.8761, with the AUD trading 0.06% lower from yesterday’s close.

On the macro front, in China, Australia’s biggest trading partner, the manufacturing PMI unexpectedly advanced to a 3-month high reading of 50.4 in October, higher than market expectations for a level of 50.2 and compared to similar reading recorded in the previous month.

Separately, the business confidence index in Australia remained unchanged at a level of 6.0 in 3Q 2014.

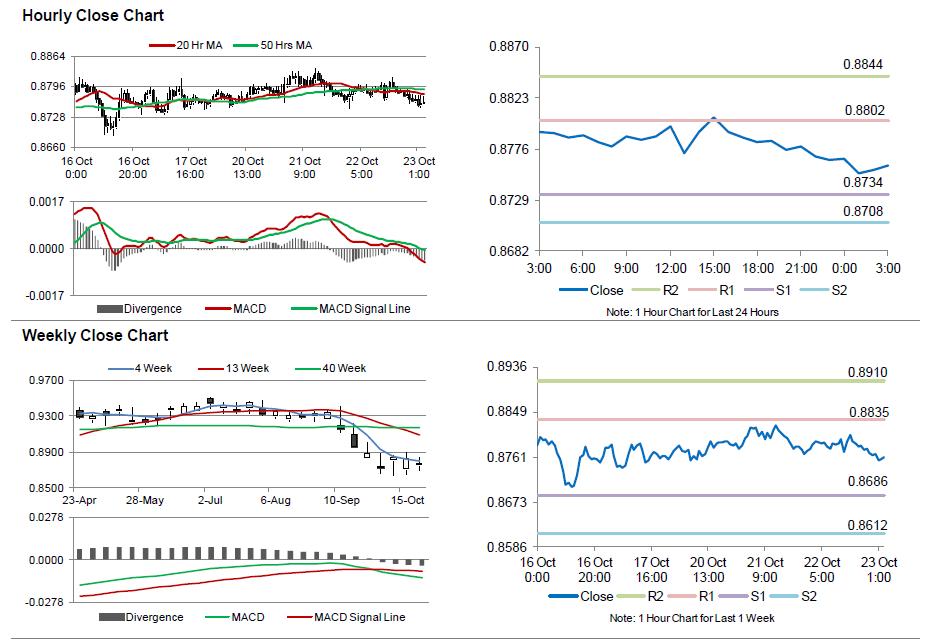

The pair is expected to find support at 0.8734, and a fall through could take it to the next support level of 0.8708. The pair is expected to find its first resistance at 0.8802, and a rise through could take it to the next resistance level of 0.8844.

Amid no economic releases from Australia, trading trends in the pair today are expected to be determined by economic news from other countries.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.