On Friday, the AUD weakened 0.33% against the USD to close at 0.8801, amid a broad strength in the greenback.

LME Copper prices rose 0.74% or $50.5/MT to $6835.5/MT. Aluminium prices rose 2.08%% or $42.0/MT to $2057.0/MT.

In the Asian session, at GMT0400, the pair is trading at 0.8728, with the AUD trading 0.83% lower from Friday’s close.

Earlier today, Australia’s building permits retreated 11.0% on a monthly basis in September, following a rise of 3.4% recorded in August, while markets were expecting it to drop 1.0% in September.

Elsewhere in China, Australia’s biggest trading partner, the non manufacturing PMI dipped to a level of 53.8 in October, compared to a reading of 54.0 in the previous month, while HSBC manufacturing PMI came in at 50.4 in October, at par with market expectations.

Over the weekend, AiG performance of manufacturing index in Australia advanced to a level of 49.4 in October, up from previous month’s reading of 46.5. Additionally, the nation’s TD securities inflation registered a rise of 0.2% on a monthly basis in October, compared to 0.1% increase registered in the prior month.

Meanwhile, the official manufacturing PMI of China fell to a level of 50.8 in October from a level of 51.1 recorded in the previous month.

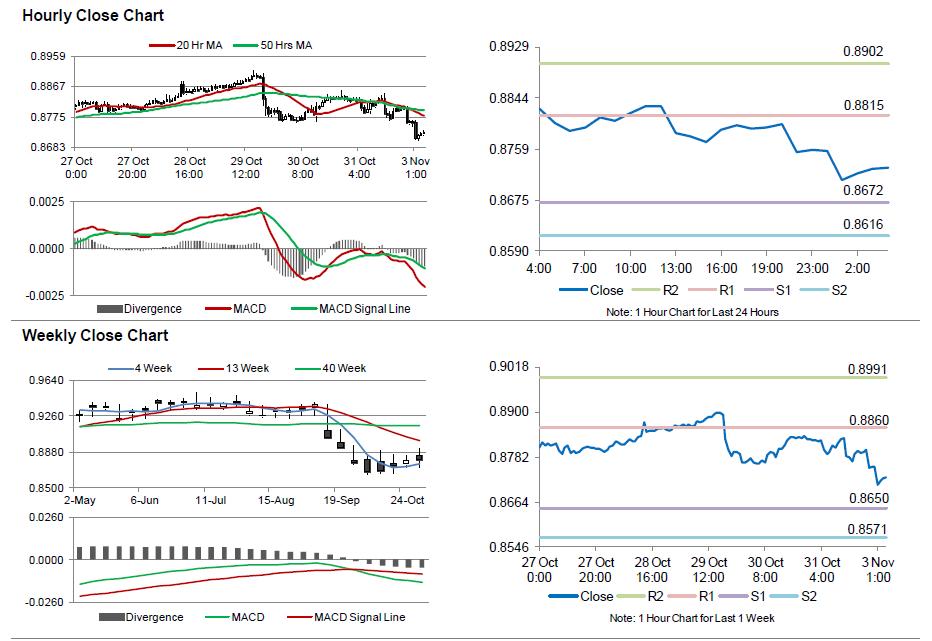

The pair is expected to find support at 0.8672, and a fall through could take it to the next support level of 0.8616. The pair is expected to find its first resistance at 0.8815, and a rise through could take it to the next resistance level of 0.8902.

Meanwhile, market participants look forward to the RBA’s interest rate decision as well as the monetary statement accompanying it, scheduled overnight.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.