For the 24 hours to 23:00 GMT, the AUD strengthened 0.23% against the USD to close at 0.6935.

China, Australia’s biggest trading partner, revised its 2014 GDP growth rate to 7.3% from a previously reported 7.4%, amid a weaker than originally reported service sector data.

LME Copper prices rose 0.40 or $20.5/MT to $5176.0/MT. Aluminium prices declined 0.84% or $13.5/MT to $1588.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.6952, with the AUD trading 0.25% higher from yesterday’s close.

Earlier today, NAB business conditions index jumped from 6 in July to 11 in the last month. Meanwhile, due to Chinese turmoil, the NBA confidence index tumbled from 4 to 1 in August.

Elsewhere, China’s trade surplus widened to $60.24 billion, after reporting a surplus of $43.03 billion in prior month.

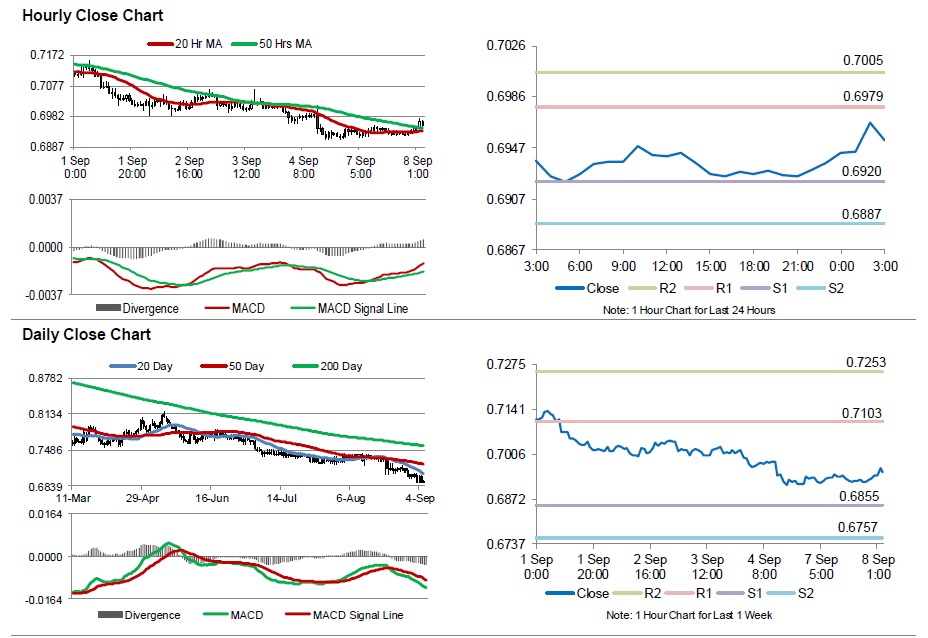

The pair is expected to find support at 0.692, and a fall through could take it to the next support level of 0.6887. The pair is expected to find its first resistance at 0.6979, and a rise through could take it to the next resistance level of 0.7005.

Going ahead, Australia’s consumer confidence data, to be released in the early hours of tomorrow, would be keenly awaited by the investors.

The currency pair is trading above its 20 and 50 hr moving averages.