For the 24 hours to 23:00 GMT, the AUD rose 0.07% against the USD and closed at 0.7554.

LME Copper prices rose 0.07% or $3.5/MT to $4805.0/MT. Aluminium prices rose 0.66% or $11.0/MT to $1684.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7523, with the AUD trading 0.41% lower against the USD from yesterday’s close.

Overnight data showed that, Australia’s consumer inflation expectations gained 3.7% in October, following a rise of 3.3% in the prior month.

Elsewhere, in China, Australia’s largest trading partner, trade surplus narrowed more-than-anticipated to a level of CNY278.4 billion in September, following a trade surplus of CNY346.0 billion in the previous month and surpassing expectations for it to narrow to a level of CNY300.0 billion. Additionally, the nation’s exports surprisingly fell by 5.6% on an annual basis in September, after recording a gain of 5.9% in the previous month while imports increased less-than-expected by 2.2% YoY in September, following a rise of 10.8% in the prior month.

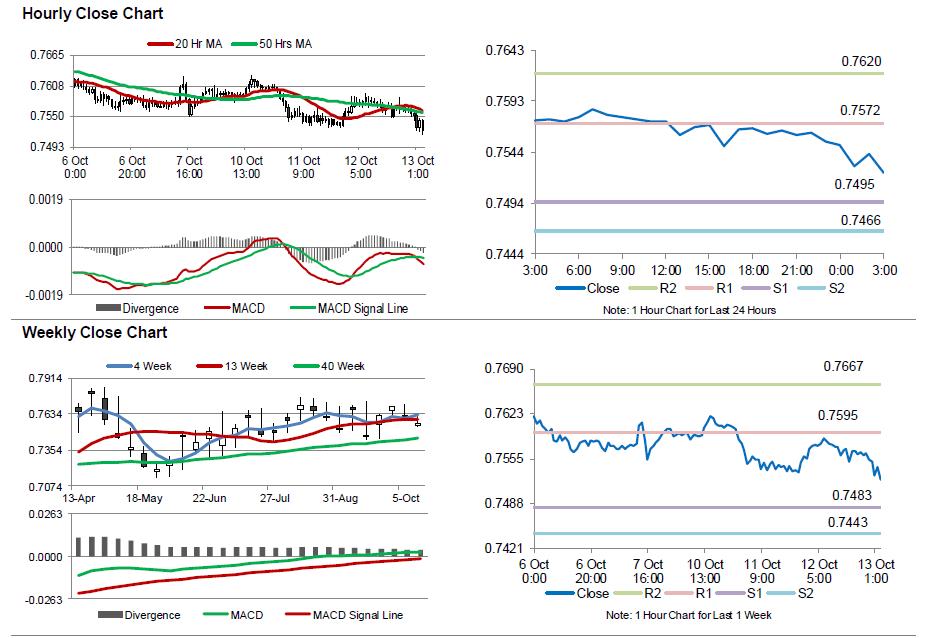

The pair is expected to find support at 0.7495, and a fall through could take it to the next support level of 0.7466. The pair is expected to find its first resistance at 0.7572, and a rise through could take it to the next resistance level of 0.7620.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.