For the 24 hours to 23:00 GMT, the AUD weakened 1.36% against the USD to close at 0.7067.

Yesterday, the World Bank slashed growth forecast for the Chinese economy, by 0.3 points to 6.7% in 2016 and by 0.4 points to 6.5% in 2017, from its June report.

LME Copper prices declined 1.01% or $47.0/MT to $4600.0/MT. Aluminium prices declined 1.09%or $16.0/MT to $1457.0/MT.

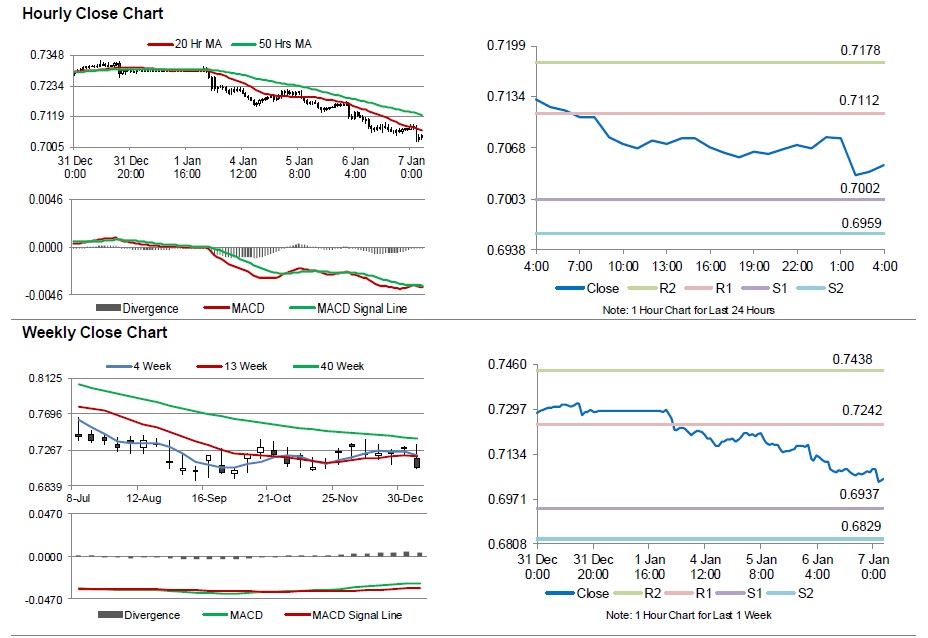

In the Asian session, at GMT0400, the pair is trading at 0.7046, with the AUD trading 0.3% lower from yesterday’s close.

Early this morning, data showed that Australia’s seasonally adjusted trade deficit narrowed to A$2.9 billion in November, compared to a revised deficit of A$3.2 billion in the previous month and against investor expectations for a trade deficit of A$3.0 billion. However, the nation’s trade balance has now been negative for 20 consecutive months. Additionally, building permits in Australia declined more-than-expected by 12.7% MoM in November, indicating the strongest decline in at least a year, after rising by a revised 3.3% in the previous month.

The pair is expected to find support at 0.7002, and a fall through could take it to the next support level of 0.6959. The pair is expected to find its first resistance at 0.7112, and a rise through could take it to the next resistance level of 0.7178.

Going ahead, market participants will concentrate on Australia’s AiG performance of construction index for December, scheduled to release tonight, to gauge the strength in the nation’s economy.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.