For the 24 hours to 23:00 GMT, the AUD strengthened 0.41% against the USD to close at 0.7748.

LME Copper prices declined 1.30% or $65.0/MT to $4935.5/MT. Aluminium prices declined 0.55% or $9.0/MT to $1632.0/MT.

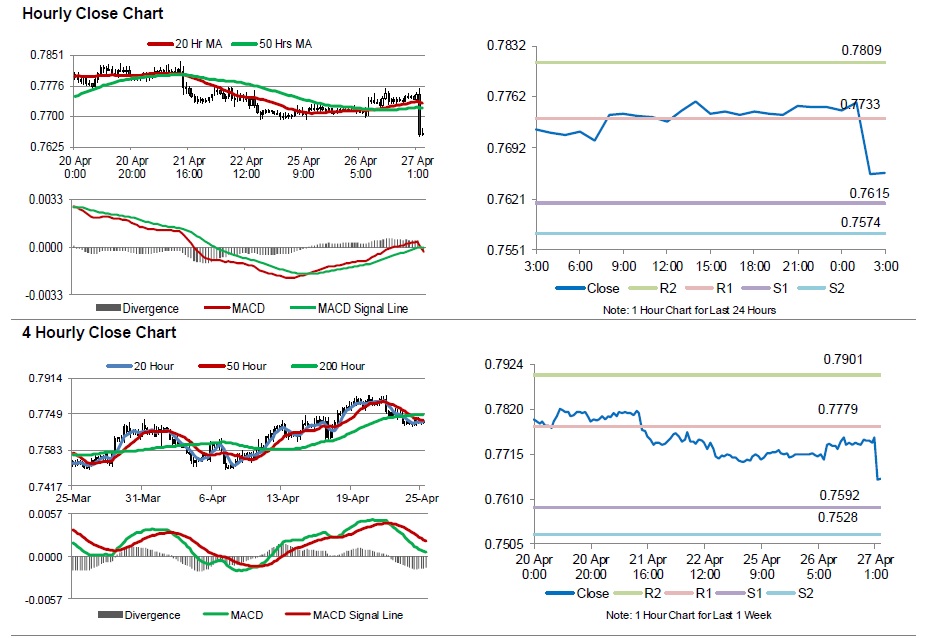

In the Asian session, at GMT0300, the pair is trading at 0.7657, with the AUD trading 1.17% lower from yesterday’s close.

Early this morning, data showed that Australia’s consumer price index (CPI) declined for the first time in seven years by 0.2% QoQ in 1Q 2016, increasing the chances of an interest rate cut by the Reserve Bank of Australia (RBA) at its meeting next month to defend its inflation target. Investors had expected it to advance 0.2%, following a 0.4% rise in the prior quarter. Meanwhile, annual inflation slowed to 1.3%, from 1.7%, mainly due to plunging oil prices.

Elsewhere, in China, Australia’s largest trading partner, the Westpac-MNI consumer sentiment index declined to a level of 117.8 in April, from a reading of 118.1 in the previous month. On the other hand, the nation’s industrial profits rebounded 11.1% YoY in March, following a 4.7% drop in the previous month, indicating that China’s economic slowdown may be bottoming out.

The pair is expected to find support at 0.7615, and a fall through could take it to the next support level of 0.7574. The pair is expected to find its first resistance at 0.7733, and a rise through could take it to the next resistance level of 0.7809.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.