For the 24 hours to 23:00 GMT, the AUD weakened 0.22% against the USD to close at 0.8768.

Yesterday, the RBA Deputy Governor, Philip Lowe urged the Australian government to take necessary actions in order to boost investment in the country as because of the existing ultra-low interest rates around the world, there was greater potential for new risks to emerge.

LME Copper prices rose 0.68% or $45.0/MT to $6660.0/MT. Aluminium prices rose/declined 0.90% or $17.5/MT to $1972.0/MT.

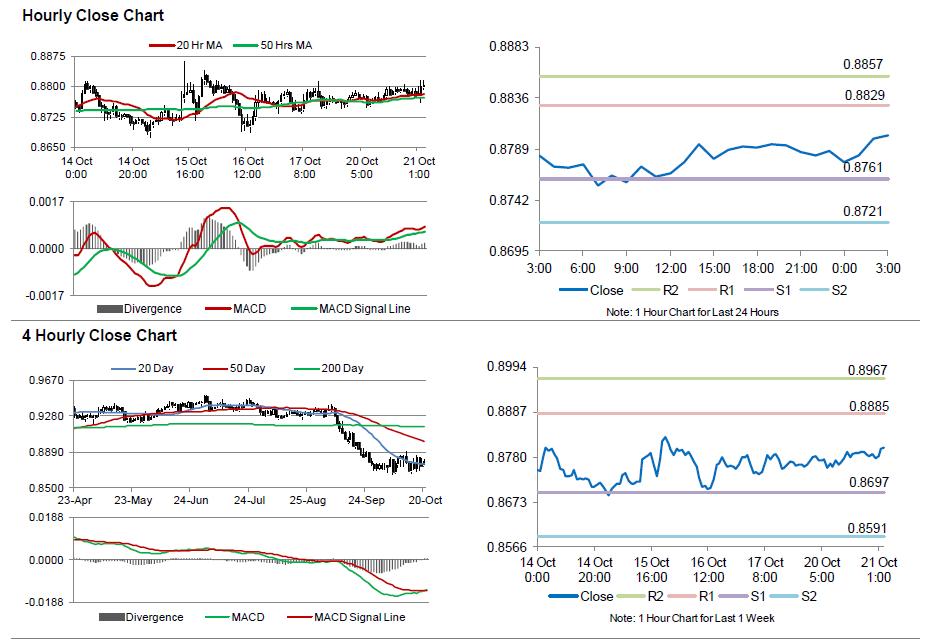

In the Asian session, at GMT0300, the pair is trading at 0.8792, with the AUD trading 0.27% higher from yesterday’s close.

Early morning data indicated that, the consumer price index (CPI) in Australia rose 0.5% on a quarterly basis in 3Q 2014, following a similar gain registered in the prior quarter and beating market expectations for an increase of 0.4%. Meanwhile, the nation’s internet skilled vacancies climbed 0.5% on a monthly basis in September. It had registered a revised rise of 0.7% in August.

In other economic data, Australia’s Westpac leading index slid 0.1% on a monthly basis in September, after registering a similar drop in the previous month. Additionally, the Conference Board leading index of Australia reported a 0.2% drop in August on a monthly basis, as compared to a revised 0.6% rise in the previous month.

The pair is expected to find support at 0.8747, and a fall through could take it to the next support level of 0.8702. The pair is expected to find its first resistance at 0.8836, and a rise through could take it to the next resistance level of 0.8880.

Trading trends in the Aussie today are expected to be determined by the RBA Governor, Glenn Steven’s speech, scheduled later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.