For the 24 hours to 23:00 GMT, AUD weakened 2.37% against the USD to close at 1.0129, over renewed Euro-zone debt concerns, amid a leadership crisis in Greece, and as Italian 10-year government bonds yield soared to more than 7%.

This morning, the consumer inflation expectation in Australia stood at 2.5% in November, compared to 3.1% in the previous month. The jobless rate in Australia declined to 5.2% in October, compared to upwardly revised 5.3% in September.

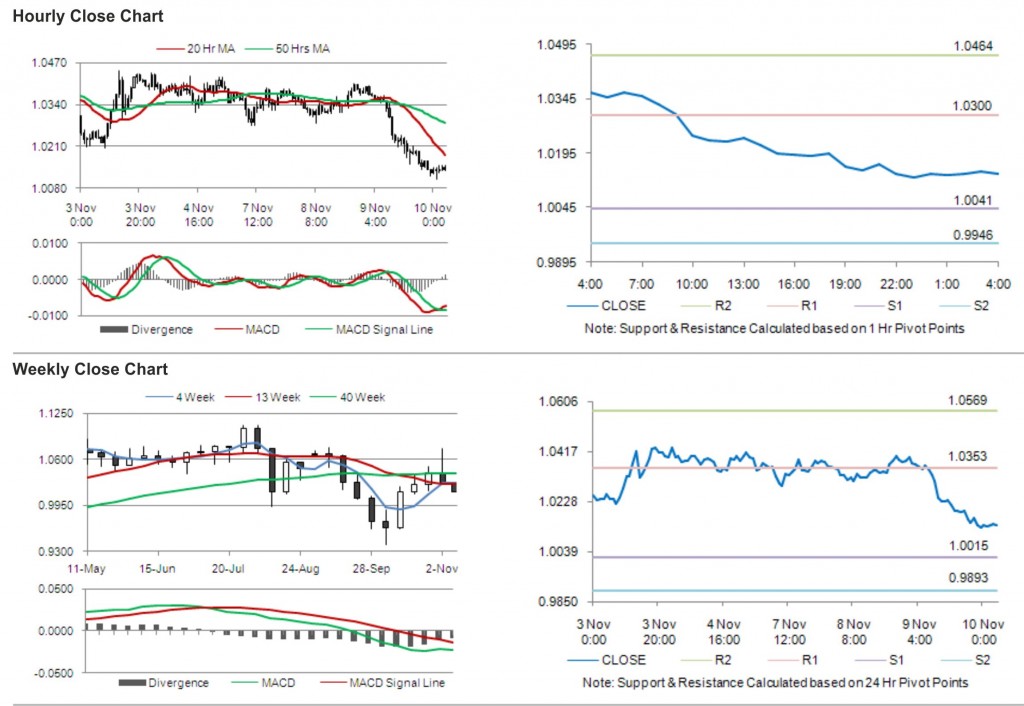

In the Asian session, at GMT0400, the pair is trading at 1.0137, with the AUD trading 0.08% higher from yesterday’s close.

LME Copper prices declined 1.9% or $148.5/MT to $7,671.8/ MT. Aluminium prices rose 0.8% or $16.0/MT to $2,108.5/ MT.

The pair is expected to find support at 1.0041, and a fall through could take it to the next support level of 0.9946. The pair is expected to find its first resistance at 1.0300, and a rise through could take it to the next resistance level of 1.0464.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.