For the 24 hours to 23:00 GMT, AUD weakened 3.06% against the USD to close at 1.0432, as concerns over the US economy and the European sovereign debt crisis deepened.

Today morning, the Reserve Bank of Australia (RBA) slashed its domestic growth forecast for 2011. In its May quarterly statement on monetary policy, the bank was expecting economic growth of 4.25% for 2011, but it has since cut this forecast to 3.25%. The RBA stated that the substantial downward revision is due to a bigger than expected fall and slower than expected recovery in coal exports, coupled with surprisingly weak consumer spending.

In the economic news, this morning, the AIG’s performance of construction index in Australia showed a reading of 36.1 in July following a reading of 35.8 in the previous month.

In the Asian session at 3:00GMT, the pair is trading at 1.0473, 0.39% higher from yesterday’s close at 23:00 GMT.

LME Copper prices declined 1.0% or $97.5/MT to $9,451.8/ MT. Aluminium prices declined 2.3% or $57.0/MT to $2,472.5/ MT.

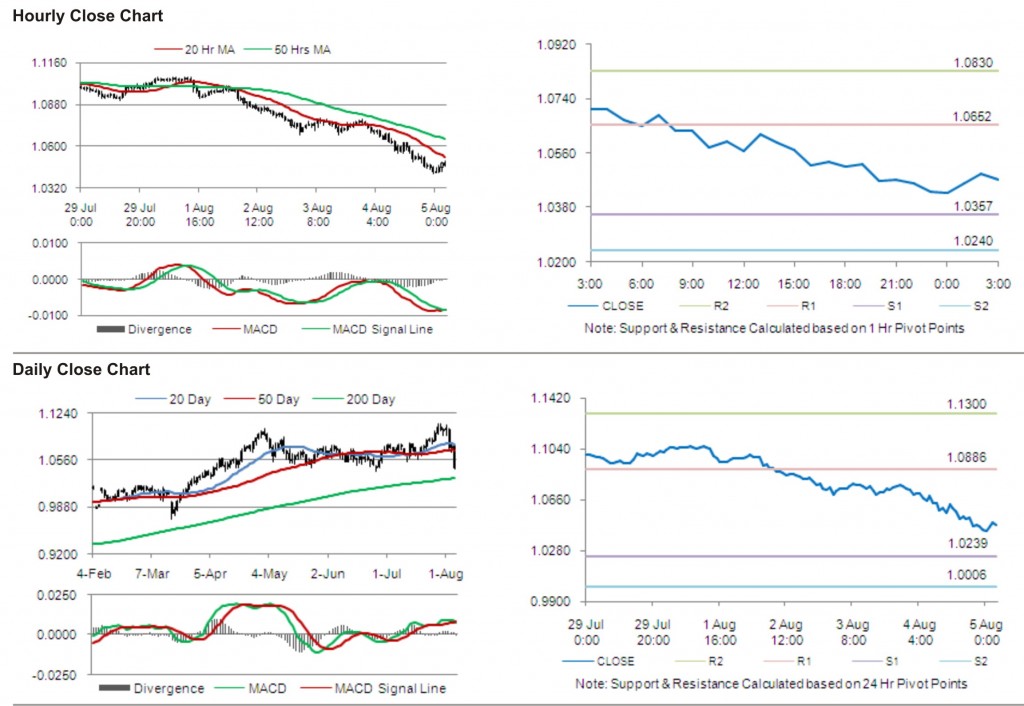

The pair is expected to find first short term resistance at 1.0652, with the next resistance levels at 1.0830 and 1.1125, subsequently. The first support for the pair is seen at 1.0357, followed by next supports at 1.0240 and 0.9945 respectively.

The currency pair is trading just below its 20 Hr and its 50 Hr moving averages.