For the 24 hours to 23:00 GMT, AUD strengthened 0.35% against the USD to close at 0.8997.

Yesterday, the Reserve Bank of Australia (RBA) Deputy Governor, Philip Lowe pointed out to the decline in the nation’s labour participation rate since late 2010 and opined that a rise in the participation rate would be essential to boost future growth rates in the economy.

LME Copper prices fell 3.3% or $222.5/MT to $6498.0/MT. Aluminium prices declined 1.7% or $29.5/MT to $1716.5/MT.

In the Asian session, at GMT0400, the pair is trading at 0.9072, with the AUD trading 0.83% higher from yesterday’s close, after data showed that, on a seasonally adjusted basis, the Australian economy added 47,300 number of jobs in February, almost three times more than market participants estimates. The data also confirmed that unemployment rate in Australia came in unchanged at previous month’s level of 6.0%, broadly in-line with analysts’ expectations. A separate report revealed that consumer inflation expectation in Australia declined to 2.1% in February, from a level of 2.3% in the preceding month.

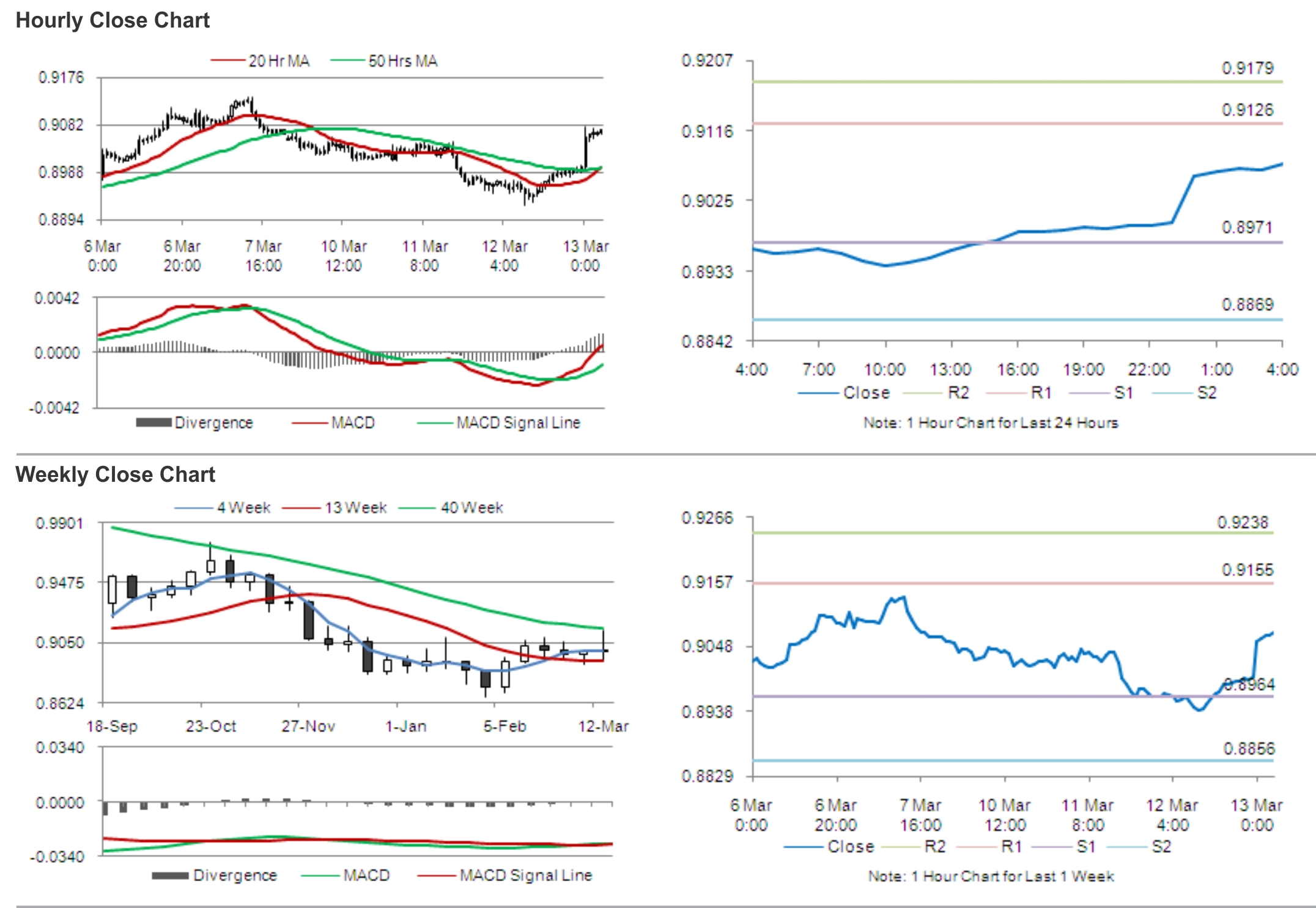

The pair is expected to find support at 0.8971, and a fall through could take it to the next support level of 0.8869. The pair is expected to find its first resistance at 0.9126, and a rise through could take it to the next resistance level of 0.9179.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.