For the 24 hours to 23:00 GMT, the AUD weakened 0.59% against the USD to close at 0.9279.

LME Copper prices declined 0.01% or $1.0/MT to $6965.5/MT. Aluminium prices rose 0.05% or $1.0/MT to $2083.0/MT.

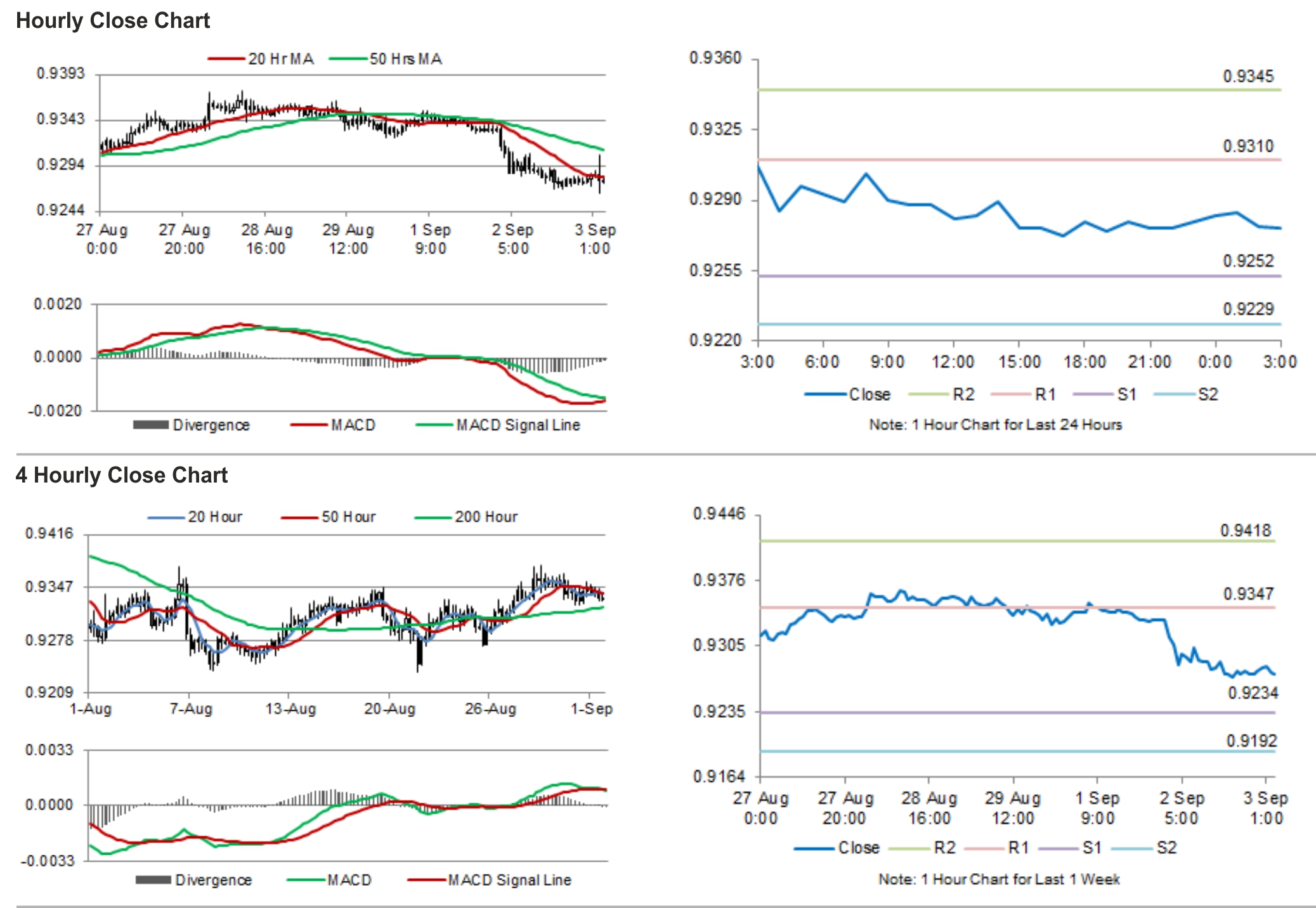

In the Asian session, at GMT0300, the pair is trading at 0.9276, with the AUD trading tad lower from yesterday’s close.

Early this morning, data indicated that Australia’s economy grew faster than expected in 2Q 2014. The nation’s seasonally adjusted GDP registered a rise of 0.5% on a quarterly basis in 2Q 2014, beating market expectations for a rise of 0.4%, following a rise of 1.1% registered, in the previous quarter. Meanwhile, the RBA Governor Glenn Stevens, in his speech, has stated that the central bank won’t allow housing prices to boom in the nation as it won’t solve the country’s economic problems. In other data, the Australian AIG performance of services index advanced to 49.4 in August, compared to a level of 49.3 in July.

Elsewhere, the services sector in China, Australia’s biggest trading partner, expanded at the strongest pace in 17 months, as the services PMI in the nation jumped to 54.1 in August, from a 9-year low of 50.0 in July. Similarly, the NBS non-manufacturing PMI in China advanced to 54.4, after registering a level of 54.2 in the prior month.

The pair is expected to find support at 0.9252, and a fall through could take it to the next support level of 0.9229. The pair is expected to find its first resistance at 0.9310, and a rise through could take it to the next resistance level of 0.9345.

Amid a lack of economic releases ahead in the day from Australia, the market participants look forward to the release of retail sales and trade balance data, scheduled for tomorrow.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.