For the 24 hours to 23:00 GMT, the AUD weakened 0.61% against the USD to close at 0.7723.

LME Copper prices rose 0.97% or $54.5/MT to $5645.5/MT. Aluminium prices declined 1.71% or $31.5/MT to $1811.5/MT.

In the Asian session, at GMT0400, the pair is trading at 0.7663, with the AUD trading 0.78% lower from yesterday’s close, after report showed that jobless rate in Australia rose more than expected in January.

Australia’s unemployment rate jumped to 6.4%, registering its worst level since August 2002 in January, compared to previous month’s 6.1% reading, while markets expected the nation’s unemployment rate to advance to a level of 6.2%. This has boosted the possibility of a further interest rate cut by the RBA. Additionally, number of employed people in the nation eased by 12.20 K in January, following a revised gain of 42.30 K in the prior month. Market anticipations were for it to fall 5.00 K.

In other economic news, consumer inflation expectations in Australia rose to a level of 4.0% in February, following a reading of 3.2% in the previous month.

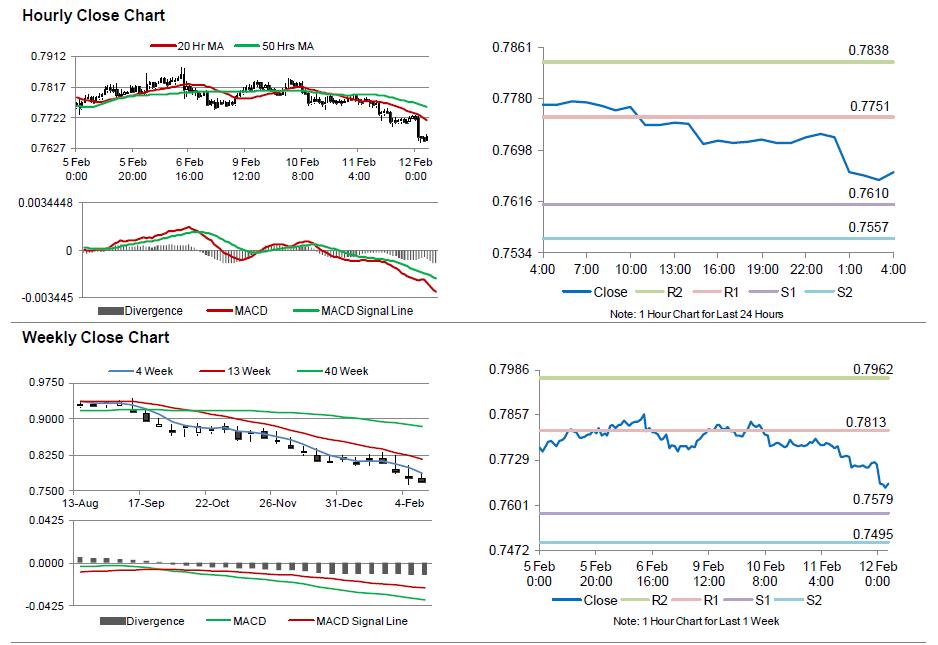

The pair is expected to find support at 0.7610, and a fall through could take it to the next support level of 0.7557. The pair is expected to find its first resistance at 0.7751, and a rise through could take it to the next resistance level of 0.7838.

Going forward, markets would keep a close eye on the RBA Governor, Glenn Stevens’ speech, scheduled in the late hours today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.