For the 24 hours to 23:00 GMT, the AUD rose 1.01% against the USD and closed at 0.7632.

LME Copper prices rose 1.1% or $71.0/MT to $6685.0/MT. Aluminium prices declined 0.4% or $7.0/MT to $1997.0/MT.

In the Asian session, at GMT0400, the pair is trading at 0.7668, with the AUD trading 0.47% higher against the USD from yesterday’s close, after Australia’s seasonally adjusted unemployment rate remained steady at a five-year low of 5.4% in November, meeting market expectations.

Moreover, the number of people employed in Australia jumped more-than-anticipated by 61.6K in November, rising by the most in more than two years. Markets had envisaged for an increase of 19.0K, following a revised gain of 7.8K in the prior month. Meanwhile, the nation’s consumer inflation expectations remained steady at 3.7% in December.

Elsewhere in China, Australia’s largest trading partner, retail sales grew 10.2% YoY in November, falling short of market expectations for a gain of 10.3%. In the previous month, the nation’s retail sales had risen 10.0%. Moreover, the nation’s industrial production climbed 6.1% on an annual basis in November, at par with market expectations and after recording an increase of 6.2% in the prior month.

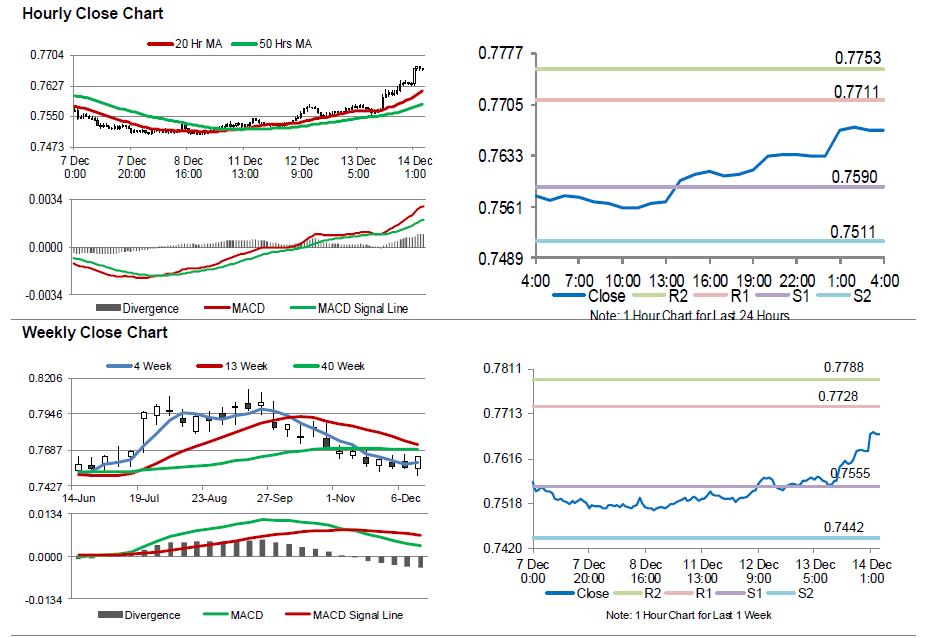

The pair is expected to find support at 0.7590, and a fall through could take it to the next support level of 0.7511. The pair is expected to find its first resistance at 0.7711, and a rise through could take it to the next resistance level of 0.7753.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.