For the 24 hours to 23:00 GMT, the AUD weakened 0.13% against the USD to close at 0.8155.

LME Copper prices declined 4.87% or $288.0/MT to $5627.0/MT. Aluminium prices rose 0.06% or $1.0/MT to $1767.5/MT.

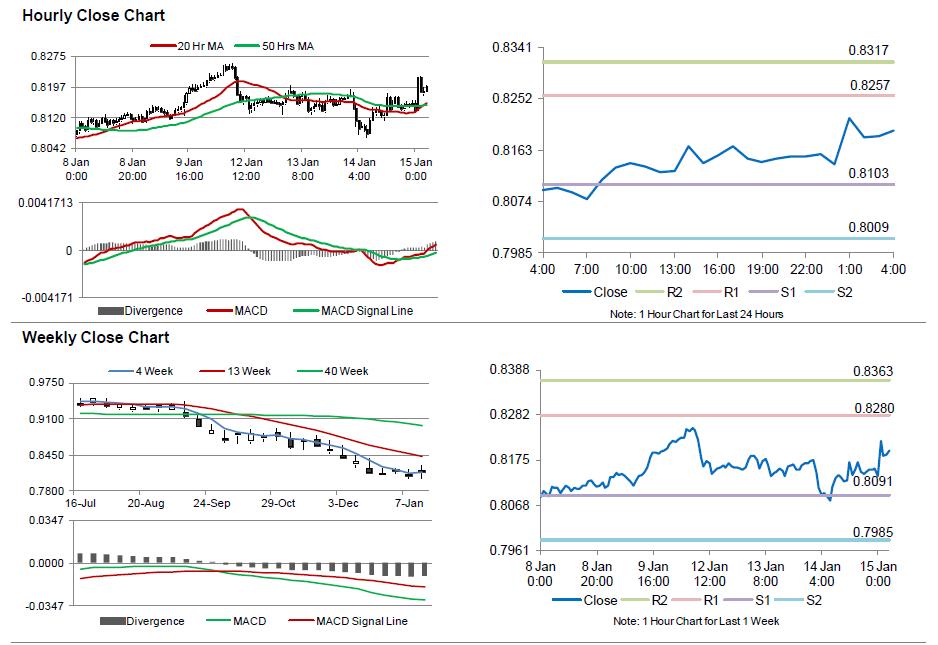

In the Asian session, at GMT0400, the pair is trading at 0.8198, with the AUD trading 0.52% higher from yesterday’s close.

Early morning data showed that Australia’s unemployment rate surprisingly dropped to 6.1% in December, compared to market expectations to rise to a level of 6.3% and following a reading of 6.2% recorded in the previous month. Additionally, number of employed people across the nation unexpectedly rose by 37,400 in December, after recording a rise of 41,600 in November. Markets were expecting number of employed people to drop by 5000.

Elsewhere, in China, Australia’s biggest trading partner, new Yuan loans dropped unexpectedly to CNY 697.30 billion in December, compared to a reading of CNY 852.70 billion in the prior month, while markets were anticipating new Yuan loans to advance to a level of CNY 880.00 billion. Meanwhile, the nation’s M1 as well as M2 money supply rose less than expected on a YoY basis in December.

The pair is expected to find support at 0.8103, and a fall through could take it to the next support level of 0.8009. The pair is expected to find its first resistance at 0.8257, and a rise through could take it to the next resistance level of 0.8317.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.