For the 24 hours to 23:00 GMT, the AUD traded marginally higher against the USD to close at 0.7637

LME Copper prices rose 0.10% or $5.5/MT to $5761.0/MT. Aluminium prices rose 1.62% or $27.0/MT to $1693.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7583, with the AUD trading 0.7% lower from yesterday’s close.

Overnight data indicated that Australia’s AiG performance of services index climbed to a level of 51.2 in June, compared to a reading of 49.6 in the preceding month.

Earlier today, data showed that Australian retail sales rebounded 0.3% MoM in May, missing market expectations for a 0.5% rise and following a 0.1% dip in April. The downbeat retail sales data would be a big blow to the RBA, after it had slashed interest rates to a record low of 2% in May to stimulate the economy, at a time when the mining investment was diminishing in the nation.

Elsewhere, in China, Australia’s biggest trading partner, the HSBC services PMI slipped to 51.8, its lowest level in five months in June, after hitting 53.5 in May but still indicated expansion for the 11th successive month.

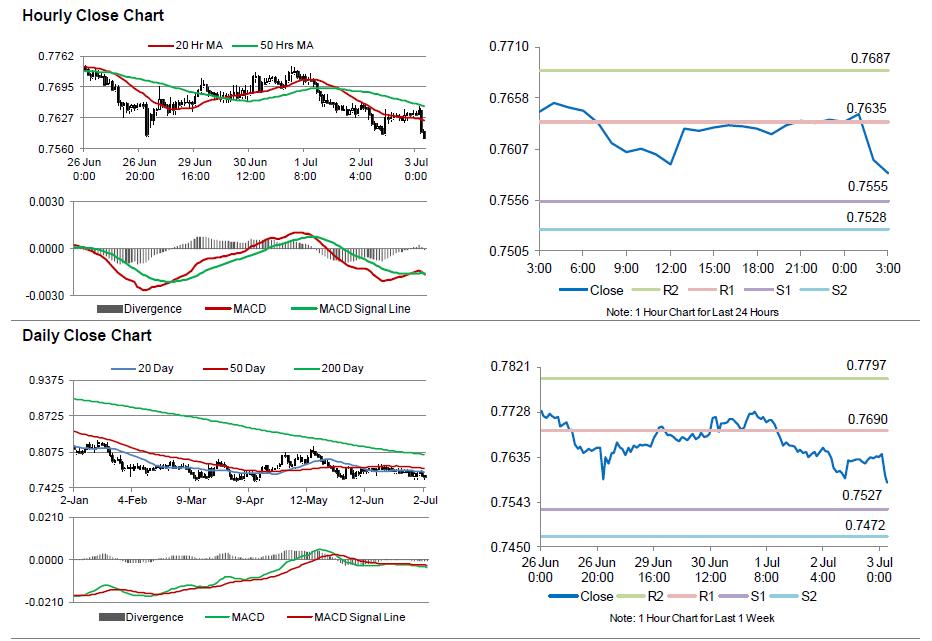

The pair is expected to find support at 0.7555, and a fall through could take it to the next support level of 0.7528. The pair is expected to find its first resistance at 0.7635, and a rise through could take it to the next resistance level of 0.7687.

Moving ahead, all eyes would be on the RBA’s crucial interest rate decision, scheduled in the next week.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.