For the 24 hours to 23:00 GMT, the AUD weakened 2.04% against the USD to close at 0.8580, amid a broad strengthening in the greenback.

Yesterday, a leading bank downgraded Australia’s economic growth projections for 2014 to 3.2% from its earlier projection of 3.4%. Additionally, the bank forecasted the nation to grow only 1.9% in 2015, from an earlier forecast of 2.5%, while the unemployment rate could rise to nearly 7%. Furthermore, the bank cautioned that the nation could be on track for its first recession in more than two decades, as it had failed to make the transition from its dependence on mining-related infrastructure to a more balanced growth model.

LME Copper prices declined 0.89% or $59.5/MT to $6646.0/MT. Aluminium prices declined 0.61% or $12.5/MT to $2038.0/MT.

In the Asian session, at GMT0400, the pair is trading at 0.8567, with the AUD trading 0.15% lower from yesterday’s close.

Early morning data indicated that, Australia’s unemployment rate rose 6.2% in October, at par with market expectations and compared to a similar level registered in the prior month. Meanwhile, number of employed people in the nation increased by 24.1 K in October, beating market expectations for an advance of 20.0 K jobs and following a revised decline of 23.7 K jobs registered in September. On the other hand, participation rate unexpectedly edged up to 64.6% in October, compared to market expectations for an unchanged reading of 64.5%.

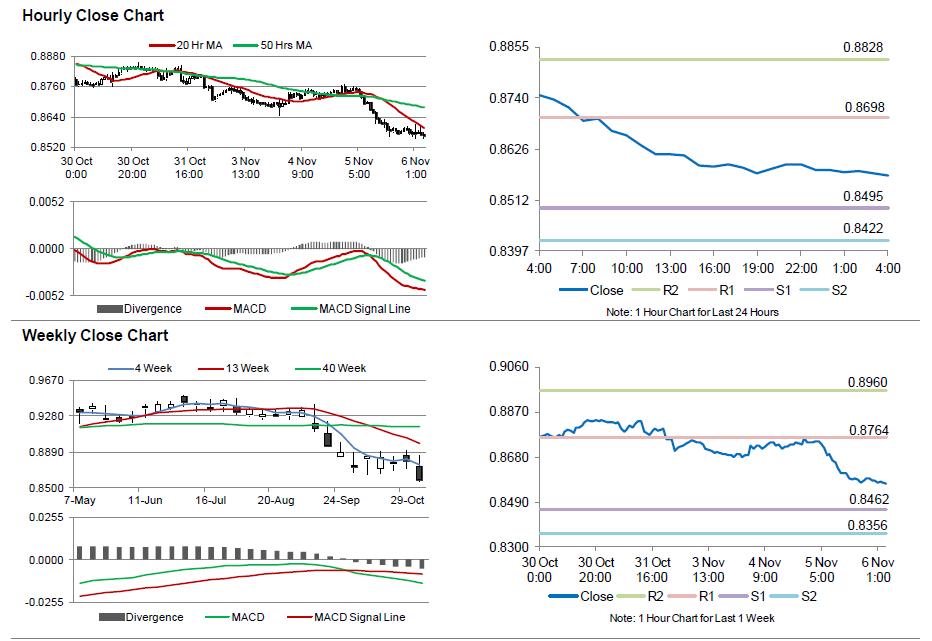

The pair is expected to find support at 0.8495, and a fall through could take it to the next support level of 0.8422. The pair is expected to find its first resistance at 0.8698, and a rise through could take it to the next resistance level of 0.8828.

Trading trends in the AUD today are expected to be determined by Australia’s AiG performance of construction index data, scheduled in the late hours today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.