For the 24 hours to 23:00 GMT, the AUD declined 0.42% against the USD and closed at 0.7181.

LME Copper prices declined 2.2% or $128.0/MT to $5823.0/MT. Aluminium prices fell 2.1% or $43.5/MT to $2040.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7206, with the AUD trading 0.35% higher against the USD from yesterday’s close, after Australia posted its best economic growth in six years.

Overnight data indicated that Australia’s seasonally adjusted gross domestic product (GDP) rose 0.9% on a quarterly basis in the second quarter of 2018, more than market expectations for an advance of 0.7%. In the prior quarter, the GDP had advanced by a revised 1.1%.

On the other hand, the nation’s AIG performance of services index fell to a level of 52.2 in August, compared to a reading of 53.6 in the prior month.

Elsewhere in China, the Caixin/Markit services PMI index dropped to 51.5 in August, compared to a reading of 52.8 in the prior month. Market expectation was for the index to ease to a level of 52.6.

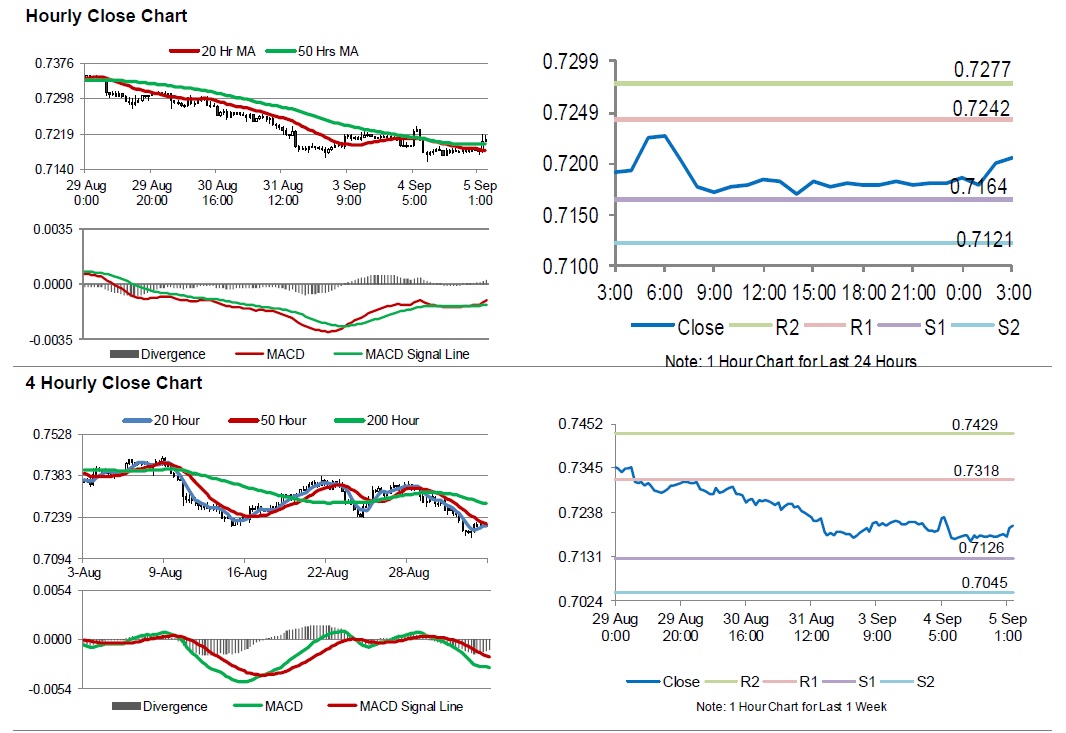

The pair is expected to find support at 0.7164, and a fall through could take it to the next support level of 0.7121. The pair is expected to find its first resistance at 0.7242, and a rise through could take it to the next resistance level of 0.7277.

Moving ahead investors would focus on Australia’s trade balance data for July, scheduled to release overnight.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.