For the 24 hours to 23:00 GMT, the AUD rose 0.6% against the USD and closed at 0.7517.

LME Copper prices declined 1.18% or $58.0/MT to $4862.0/MT. Aluminium prices declined 0.66% or $10.5/MT to $1590.5/MT.

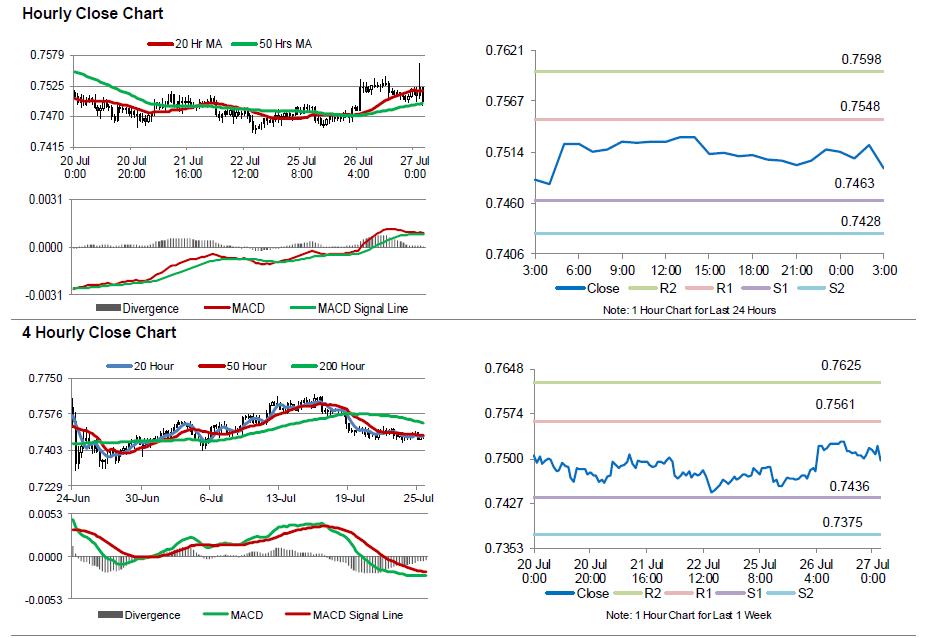

In the Asian session, at GMT0300, the pair is trading at 0.7497, with the AUD trading 0.27% lower against the USD from yesterday’s close.

The Australian Dollar lost ground, after early morning data revealed that the annual consumer price index in Australia rose at the slowest annual pace since 1999, after it climbed by 1.0% in 2Q 2016, undershooting market expectations for a rise of 1.1%, thus increasing the prospects for a rate cut from the Reserve Bank of Australia as early as next week. The index had recorded a rise of 1.3% in the previous quarter. Meanwhile, on a quarterly basis, the consumer price index advanced by 0.4% in 2Q 2016, at par with investor expectations and compared to a fall of 0.2% in the previous quarter.

Elsewhere, in China, Australia’s largest trading partner, industrial profits rose by 5.1% YoY in June, compared to a rise of 3.7% in the preceding month. Also, the nation’s Westpac-MNI consumer sentiment index fell to a level of 114.0 in July, compared to a level of 115.9 in the previous month.

The pair is expected to find support at 0.7463, and a fall through could take it to the next support level of 0.7428. The pair is expected to find its first resistance at 0.7548, and a rise through could take it to the next resistance level of 0.7598.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.