For the 24 hours to 23:00 GMT, the AUD declined 0.44% against the USD and closed at 0.7618.

LME Copper prices declined 0.4% or $29.0/MT to $6768.0/MT. Aluminium prices rose 0.5% or $10.0/MT to $2100.0/MT.

In the Asian session, at GMT0400, the pair is trading at 0.7629, with the AUD trading 0.14% higher against the USD from yesterday’s close, following upbeat Australian economic data.

Overnight data indicated that Australia’s NAB business conditions index jumped to a record high level of 21.0 in October, suggesting that businesses are growing much more confident about the nation’s improving economic conditions and strengthening labour market. In the prior month, the index had registered a level of 14.0. Also, the nation’s NAB business confidence index remained unchanged at a level of 8.0 in October.

Elsewhere, in China, Australia’s largest trading partner, industrial production advanced less-than-anticipated by 6.2% on an annual basis in October, pointing to a slowdown in the nation’s industrial sector. Markets had anticipated industrial production to gain 6.3%, compared to a rise of 6.6% in the prior month. Moreover, the nation’s retail sales rose 10.0% YoY in October, undershooting market expectations for an increase of 10.5%. Retail sales had recorded a rise of 10.3% in the prior month.

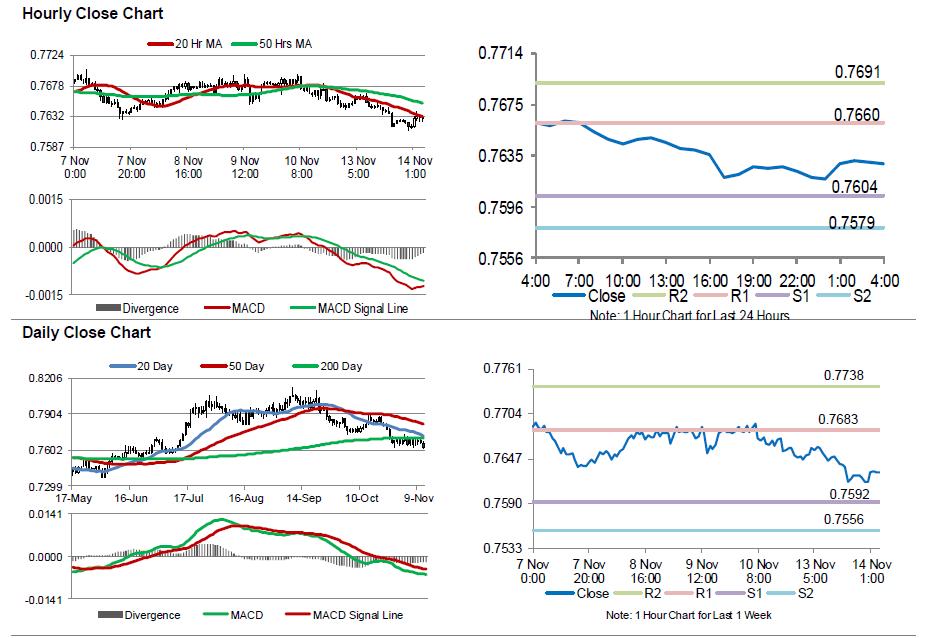

The pair is expected to find support at 0.7604, and a fall through could take it to the next support level of 0.7579. The pair is expected to find its first resistance at 0.7660, and a rise through could take it to the next resistance level of 0.7691.

Going forward, Australia’s Westpac consumer confidence index for November, due to release overnight, will be on investors’ radar.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.