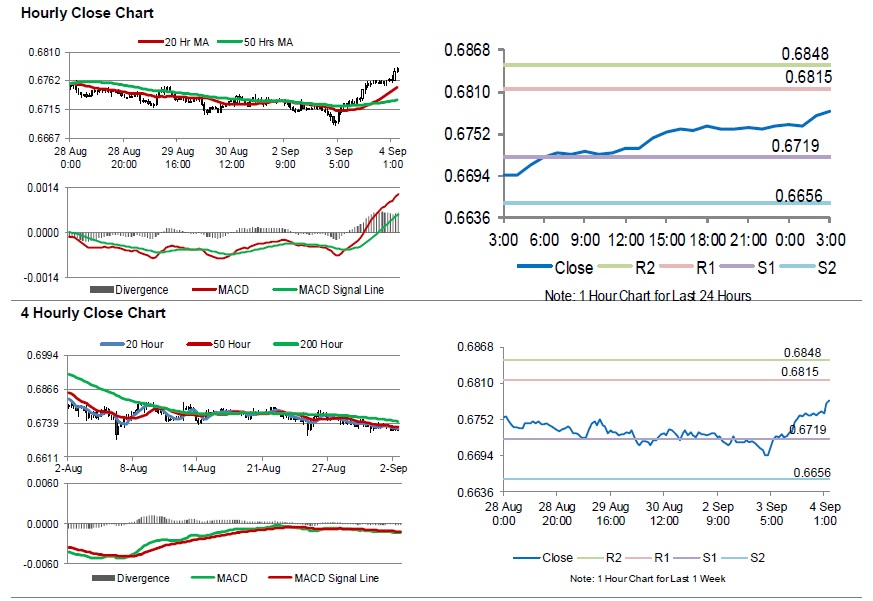

For the 24 hours to 23:00 GMT, the AUD rose 0.73% against the USD and closed at 0.6762.

LME Copper prices declined 1.3% or $73.5/MT to $5537.0/MT. Aluminium prices rose 0.1% or $2.0/MT to $1714.5/MT.

In the Asian session, at GMT0300, the pair is trading at 0.6783, with the AUD trading 0.31% higher against the USD from yesterday’s close.

Overnight data showed that Australia’s seasonally adjusted gross domestic product (GDP) climbed 0.5% on a quarterly basis in 2Q 2019, at par with market consensus. In the prior quarter, the GDP had recorded a revised gain of 0.5%. Moreover, the nation’s AIG performance of service index expanded to a level of 51.4 in August, compared to a reading of 43.9 in the previous month. Meanwhile, the CBA services PMI fell to a level of 49.1 in August, following a reading of 49.2 in the preceding month.

Elsewhere in China, Australia’s largest trading partner, the Caixin/Markit services PMI climbed to a 3-month high level of 52.1 in August, more than market expectations for a rise to a level of 51.6. In the prior month, the PMI had registered a reading of 51.6.

The pair is expected to find support at 0.6719, and a fall through could take it to the next support level of 0.6656. The pair is expected to find its first resistance at 0.6815, and a rise through could take it to the next resistance level of 0.6848.

Going forward, traders would closely monitor Australia’s trade balance data for July, scheduled to release overnight.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.