For the 24 hours to 23:00 GMT, the AUD strengthened 0.17% against the USD to close at 0.7045.

Yesterday, the Organisation for Economic Co-operation and Development (OECD), projected Australian economy to grow by 2.6% in 2016, down from 3.0% expansion predicted previously. The agency expects Australia’s economy to pick up in 2017 to record a growth of 3.0%. Meanwhile, it expressed concerns over China’s trade slowdown, and cautioned that it will affect global economic growth this year.

LME Copper prices declined 0.20% or $10.0 /MT to $4990.0 /MT. Aluminium prices rose 0.97% or $14.5 /MT to $1506.0 /MT.

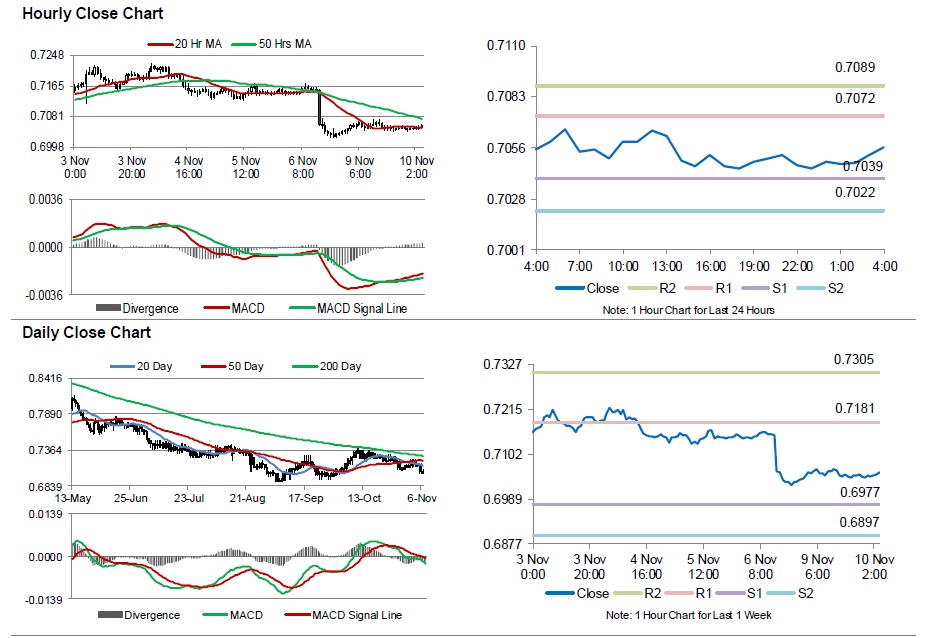

In the Asian session, at GMT0400, the pair is trading at 0.7056, with the AUD trading 0.16% higher from yesterday’s close.

Early morning data showed that Australia’s home loan approvals unexpectedly rose 2.0% in September, from a revised 1.5% in the previous month. Investors had expected it to remain flat.

On the other hand, the nation’s business confidence index fell to a level of 2.0 in October, from a reading of 5.0 in the previous month.

Elsewhere, in China, Australia’s biggest trade partner, consumer price inflation fell more-than-expected by 0.3% MoM in October, following a rise of 0.1% in the previous month despite the PBoC’s efforts to boost demand in the world’s second-largest economy by introducing a series of interest rate cuts. Investors had expected it to decline 0.2%. Also, the nation’s producer price inflation dropped 5.9% YoY in the same month, meeting expectations, and after witnessing a similar fall in the previous month.

The pair is expected to find support at 0.7039, and a fall through could take it to the next support level of 0.7022. The pair is expected to find its first resistance at 0.7072, and a rise through could take it to the next resistance level of 0.7089.

Moving ahead, market participants will concentrate on Australia’s Westpac consumer confidence index data for November, scheduled to be released overnight.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.