For the 24 hours to 23:00 GMT, the AUD rose 0.38% against the USD and closed at 0.7679.

LME Copper prices declined 0.7% or $51.0/MT to $6812.0/MT. Aluminium prices declined 1.3% or $27.5/MT to $2103.5/MT.

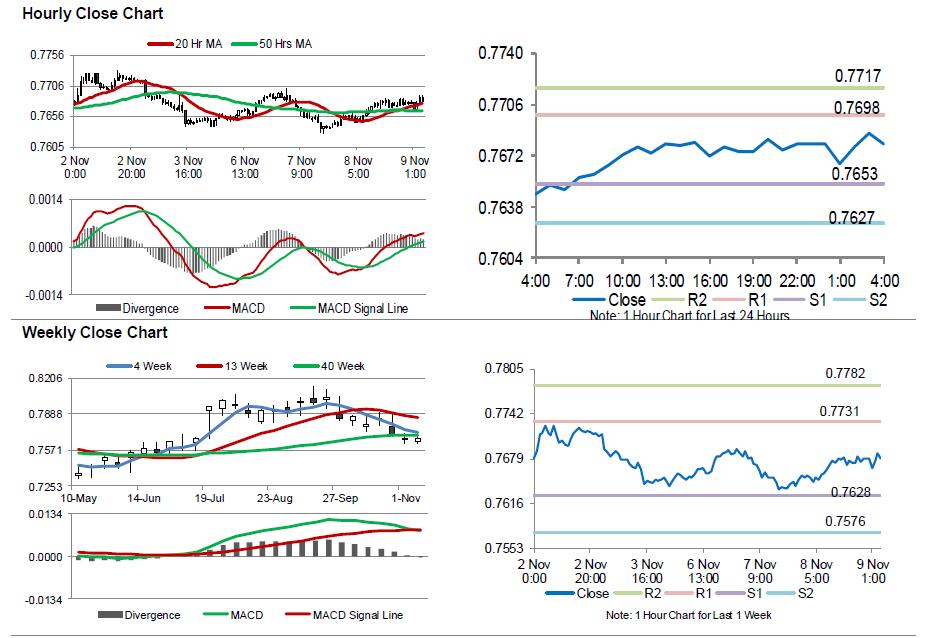

In the Asian session, at GMT0400, the pair is trading at 0.7680, with the AUD trading marginally higher against the USD from yesterday’s close.

Overnight data revealed Australia’s seasonally adjusted home loan approvals unexpectedly declined by 2.3% on a monthly basis in September, defying market consensus for a rise of 2.0%. In the prior month, home loan approvals had risen 1.0%.

Elsewhere in China, Australia’s largest trading partner, the consumer price index (CPI) advanced more-than-expected by 1.9% on an annual basis in October, accelerating to a nine-month high and following a rise of 1.6% in the previous month. Market participants had anticipated the CPI to climb 1.8%. Further, the nation’s producer price index rose 6.9% on a yearly basis in October, compared to a similar rise in the previous month, while markets had expected for a rise of 6.6%.

The pair is expected to find support at 0.7653, and a fall through could take it to the next support level of 0.7627. The pair is expected to find its first resistance at 0.7698, and a rise through could take it to the next resistance level of 0.7717.

Looking ahead, market participants would eye the Reserve Bank of Australia’s monetary policy statement, slated to release overnight.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.