For the 24 hours to 23:00 GMT, the AUD declined 0.16% against the USD and closed at 0.6787.

LME Copper prices rose 1.0% or $60.0/MT to $5813.0/MT. Aluminium prices rose 0.3% or $5.0/MT to $1753.0/MT.

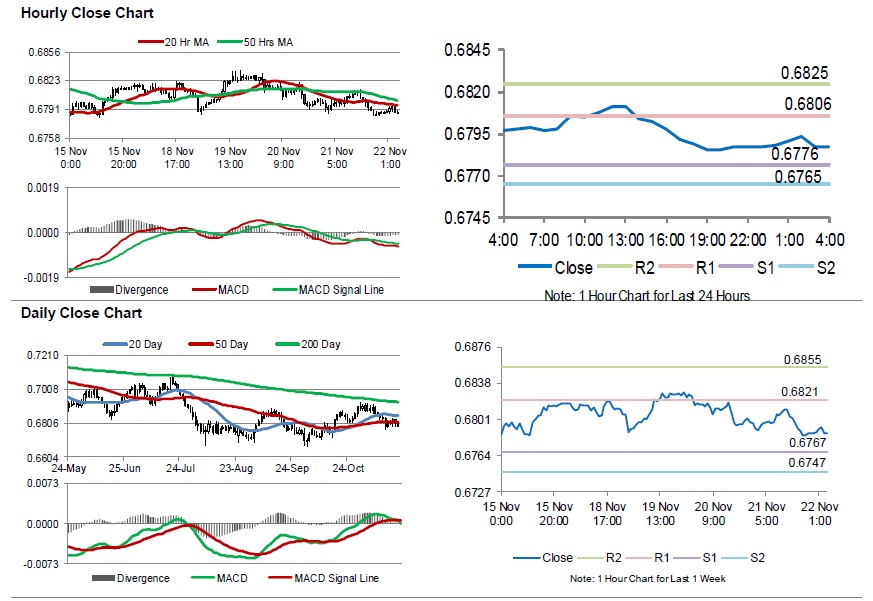

In the Asian session, at GMT0400, the pair is trading at 0.6787, with the AUD trading flat against the USD from yesterday’s close.

Overnight data showed that Australia’s manufacturing PMI contracted to a level of 49.9 in November, less than market expectations for a drop to a level of 49.8. In the previous month, the PMI had recorded a reading of 50.0. Moreover, the nation’s services PMI unexpectedly contracted to a level of 49.5 in November, defying market anticipations for a rise to a level of 53.5. In the previous month, the PMI had recorded a reading of 50.1.

The Paris-based international organization (OECD) stated that China’s economy is expected to improve to 6.2% in 2019 from 6.1% earlier predicted. However, the OECD forecasted that the economic growth would decline to 5.7% in 2020 and 5.5% in 2021, weighed down by continuous trade tension.

The pair is expected to find support at 0.6776, and a fall through could take it to the next support level of 0.6765. The pair is expected to find its first resistance at 0.6806, and a rise through could take it to the next resistance level of 0.6825.

In absence of key economic releases in Australia today, investor sentiment would be determined by global macroeconomic events.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.