For the 24 hours to 23:00 GMT, the AUD declined 0.18% against the USD and closed at 0.7558.

LME Copper prices rose 0.1% or $4.5/MT to $6761.0/MT. Aluminium prices declined 1.4% or $29.0/MT to $2033.0/MT.

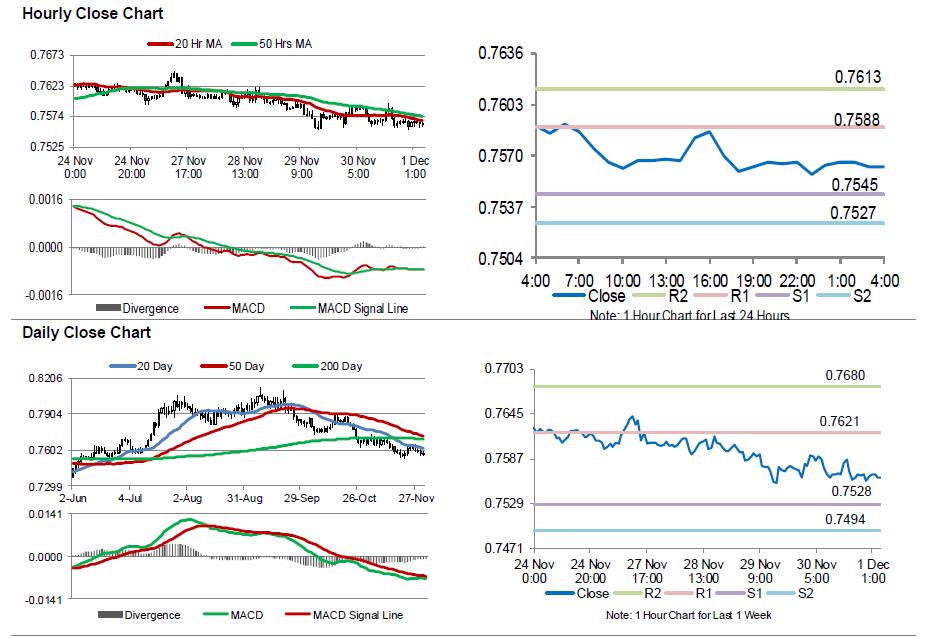

In the Asian session, at GMT0400, the pair is trading at 0.7563, with the AUD trading 0.07% higher against the USD from yesterday’s close.

Overnight data revealed that Australia’s AiG performance of manufacturing index sharply advanced to a level of 57.3 in November, indicating that manufacturing sector is expanding at an accelerated pace. The index had recorded a reading of 51.1 in the prior month.

Elsewhere, in China, Australia’s largest trading partner, the Caixin/Markit manufacturing PMI index dropped more-than-anticipated to a level of 50.8 in November, dipping to its lowest in five months. The PMI had registered a reading of 51.0 in the prior month, while markets were anticipating the PMI to ease to a level of 50.9.

The pair is expected to find support at 0.7545, and a fall through could take it to the next support level of 0.7527. The pair is expected to find its first resistance at 0.7588, and a rise through could take it to the next resistance level of 0.7613.

Next week, investors would keep a close watch on the Reserve Bank of Australia’s (RBA) interest rate decision.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.