For the 24 hours to 23:00 GMT, the AUD declined 1.36% against the USD and closed at 0.7385.

LME Copper prices declined 0.66% or $38.0/MT to $5740.0/MT. Aluminium prices rose 0.03% or $0.5/MT to $1722.5/MT.

In the Asian session, at GMT0400, the pair is trading at 0.7401, with the AUD trading 0.22% higher against the USD from yesterday’s close.

Overnight data showed that Australia’s AiG performance of manufacturing index advanced to a level of 54.2 in November, hitting its highest level seen since July 2014 and compared to a level of 50.9 in the prior month.

Elsewhere, in China, Australia’s largest trading partner, the NBS manufacturing PMI expanded more-than-expected to a level of 51.7 in November, expanding at its fastest pace in more than two years, thus highlighting that the world’s second largest economy is gathering steam. Meanwhile, markets expected the index to record a level of 51.0, following a reading of 51.2 in the previous month. Additionally, the nation’s NBS non-manufacturing PMI advanced to a level of 54.7 in November, posting its strongest reading since June 2014, after registering a reading of 54.0 in the previous month. Moreover, the nation’s Caixin manufacturing PMI index expanded for the fifth straight month, after it advanced to a level of 50.9 in November, but falling short of market expectations for the index to expand to a level of 51.0 and compared to a reading of 51.2 in the previous month.

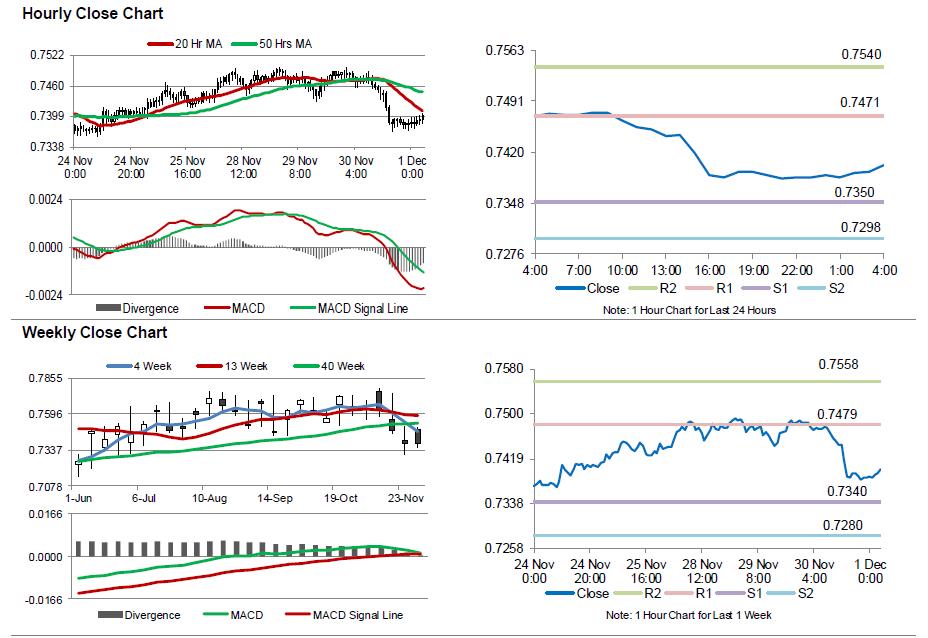

The pair is expected to find support at 0.735, and a fall through could take it to the next support level of 0.7298. The pair is expected to find its first resistance at 0.7471, and a rise through could take it to the next resistance level of 0.754.

Looking ahead, investors would keep a close watch on Australia’s retail sales data for October, scheduled to be released overnight.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.