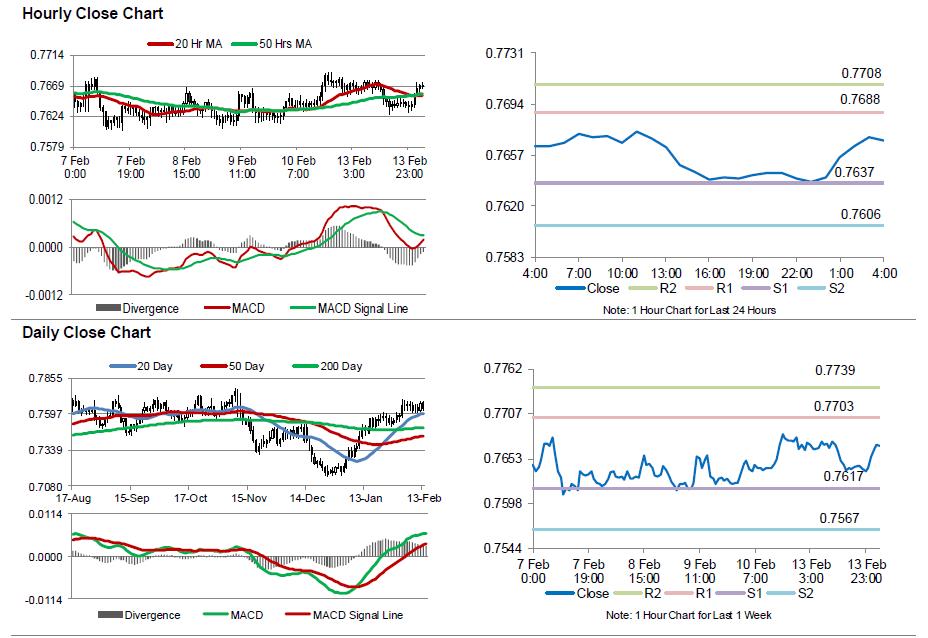

For the 24 hours to 23:00 GMT, the AUD declined 0.42% against the USD and closed at 0.7638.

LME Copper prices rose 4.1% or $239.0/MT to $6111.0/MT. Aluminium prices rose 1.0% or $18.5/MT to $1867.5/MT.

In the Asian session, at GMT0400, the pair is trading at 0.7668, with the AUD trading 0.39% higher against the USD from yesterday’s close.

Early morning data indicated that Australia’s NAB business confidence index climbed to a three-year high level of 10.0 in January, highlighting that the economy is gaining momentum. The index had registered a reading of 6.0 in the previous month. Also, the nation’s business conditions index jumped to a level of 16.0 in January, marking its highest level in more than nine years and following a revised level of 10.0 in the preceding month.

Earlier today, in China, Australia’s largest trading partner, the consumer price index (CPI) rose more-than-expected by 2.5% YoY in January, rising to its highest level the highest since May 2014 amid a surge in fuel and food prices. The CPI had registered an advance of 2.1% in the prior month, while market anticipation was for the index to rise 2.4%. Moreover, the nation’s producer price index jumped to a nearly six-year high level, after it advanced 6.9% on an annual basis in January, surpassing market consensus for an increase of 6.5%. In the prior month, the index had climbed 5.5%.

The pair is expected to find support at 0.7637, and a fall through could take it to the next support level of 0.7606. The pair is expected to find its first resistance at 0.7688, and a rise through could take it to the next resistance level of 0.7708.

Looking ahead, Australia’s Westpac consumer confidence index for February, scheduled to release overnight, will keep investors on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.