For the 24 hours to 23:00 GMT, the AUD rose 0.19% against the USD and closed at 0.7987 on Friday.

LME Copper prices declined 0.7% or $42.0/MT to $6283.0/MT. Aluminium prices declined 1.6% or $31.0/MT to $1892.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7978, with the AUD trading 0.11% lower against the USD from Friday’s close.

Early morning data indicated that Australia’s HIA new home sales fell 6.9% MoM in June, hitting its lowest level since 2013. New home sales had recorded a rise of 1.1% in the previous month. On the contrary, the nation’s private sector credit climbed more-than-expected by 0.6% on a monthly basis in June, compared to an advance of 0.4% in the previous month.

Elsewhere, in China, Australia’s largest trading partner, the NBS manufacturing PMI fell to a level of 51.4 in July, undershooting market consensus for a fall to a level of 51.5. In the prior month, the PMI had recorded a reading of 51.7. Moreover, the nation’s NBS non-manufacturing PMI dropped to a level of 54.5 in July, compared to a level of 54.9 in the previous month.

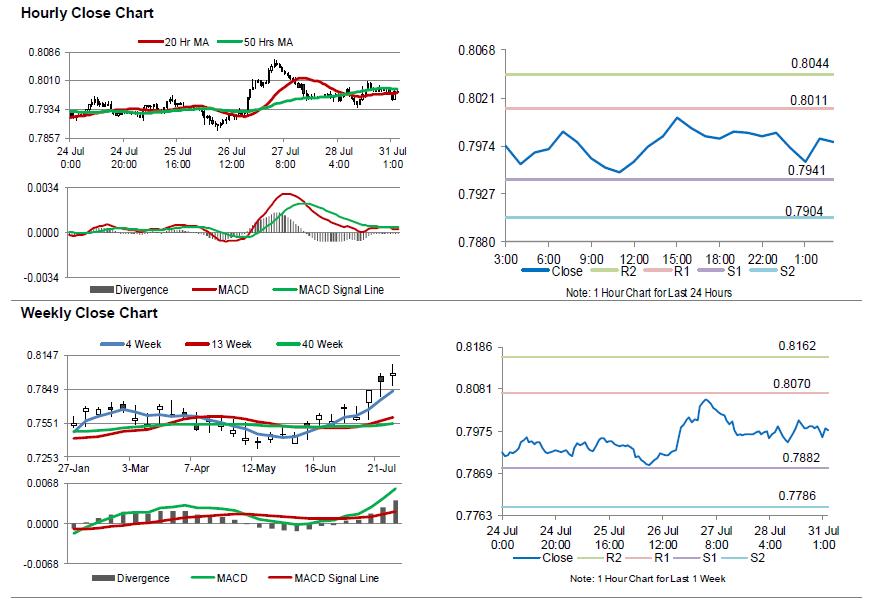

The pair is expected to find support at 0.7941, and a fall through could take it to the next support level of 0.7904. The pair is expected to find its first resistance at 0.8011, and a rise through could take it to the next resistance level of 0.8044.

Looking ahead, traders will focus on the Reserve Bank of Australia’s (RBA) interest rate decision slated to release tomorrow. Moreover, Australia’s AiG performance of manufacturing index for July, slated to release overnight, will also pique investor attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.