For the 24 hours to 23:00 GMT, the AUD strengthened 0.38% against the USD to close at 0.7046.

LME Copper prices declined 0.09% or $4.5/MT to $5090.5/MT. Aluminium prices declined 0.48% or $7.5/MT to $1570.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7021, with the AUD trading 0.35% lower from yesterday’s close, on the back of downbeat retail sales data in Australia.

Early morning data indicated that retail sales in Australia dipped 0.1% MoM in July, registering its first drop since May 2014 and compared to prior month’s revised increase of 0.6%, thus indicating deterioration in the nation’s economy. Markets were expecting the retail sales to rise 0.4% in July.

Other economic data revealed that Australian trade deficit unexpectedly narrowed to A$2460.0 million in July, following prior month’s revised deficit of A$3050.0 million.

Overnight data showed that Australia’s AiG performance of service index advanced to a level of 55.6 in August, from a reading of 54.1 in July.

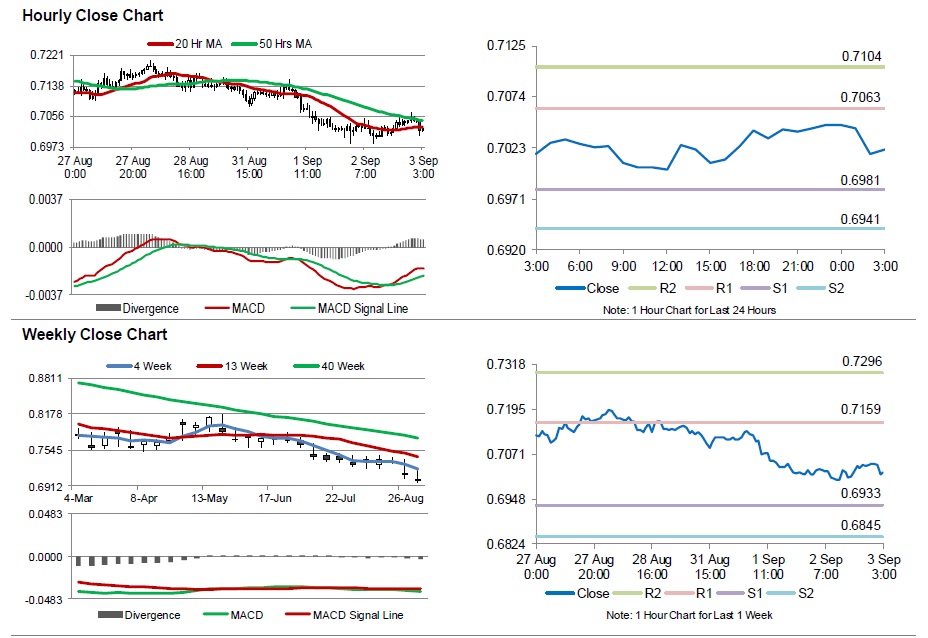

The pair is expected to find support at 0.6981, and a fall through could take it to the next support level of 0.6941. The pair is expected to find its first resistance at 0.7063, and a rise through could take it to the next resistance level of 0.7104.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.