For the 24 hours to 23:00 GMT, the AUD strengthened 0.23% against the USD to close at 0.7252.

LME Copper prices declined 2.11% or $99.0 /MT to $4601.0 /MT. Aluminium prices declined 0.26% or $4.0 /MT to $1544.0 /MT.

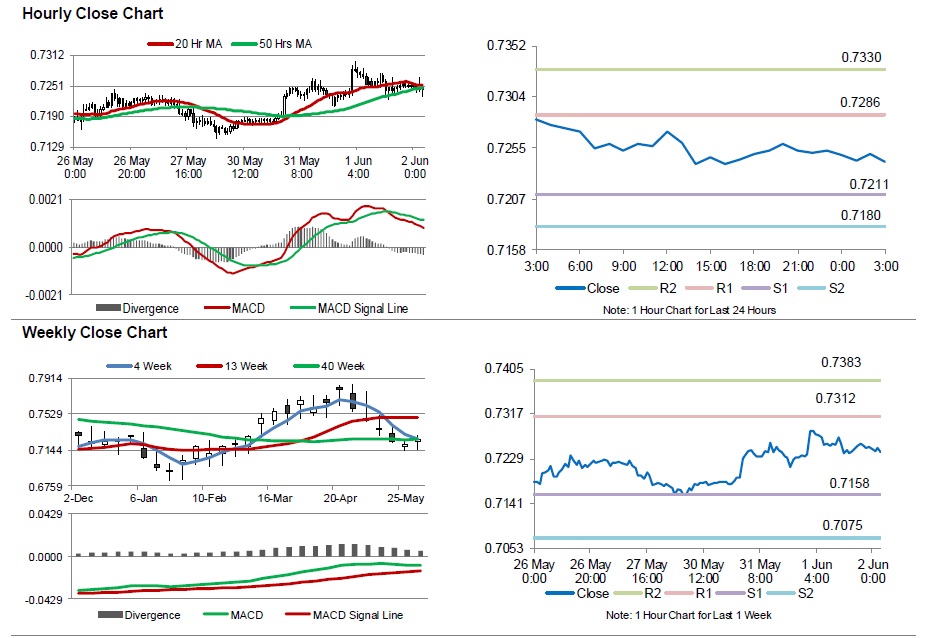

In the Asian session, at GMT0300, the pair is trading at 0.7242, with the AUD trading 0.14% lower from yesterday’s close.

Early this morning, data showed that Australia’s trade deficit narrowed for the fourth consecutive month to A$1579.0 million in April, from a revised trade deficit of A$1971.0 million in the prior month. Markets were anticipating the nation’s trade deficit to widen to A$2100.0 million. The result was driven by a 1.0% rise in exports and a similar rate of decline in imports. On the other hand, the nation’s seasonally adjusted retail sales rose less-than-expected by 0.2% MoM in April, compared to market expectations for a rise of 0.3% and following a 0.4% growth in the previous month.

Separately, the Organisation for Economic Co-operation and Development (OECD), indicated that interest rates in Australia might begin to increase in 2017.

The pair is expected to find support at 0.7211, and a fall through could take it to the next support level of 0.7180. The pair is expected to find its first resistance at 0.7286, and a rise through could take it to the next resistance level of 0.7330.

Moving ahead, market participants will look forward to Australia’s AiG performance of services index for May, scheduled to release overnight.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.