For the 24 hours to 23:00 GMT, the AUD declined 1.49% against the USD and closed at 0.7426.

LME Copper prices declined 1.9% or $110.0/MT to $5636.5/MT. Aluminium prices rose 0.4% or $7.0/MT to $1916.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7411, with the AUD trading 0.2% lower against the USD from yesterday’s close.

Earlier today, data showed that Australia’s seasonally adjusted trade surplus narrowed more-than-expected to a level of A$3107.0 million in March, following a revised surplus of A$3657.0 million in the previous month, while market participants had envisaged for a surplus of A$3250.0 million. Further, the nation’s HIA new home sales dropped 1.1% on a monthly basis in March. In the prior month, new home sales had recorded a rise of 0.2%.

Meanwhile, the Reserve Bank of Australia’s (RBA) Governor, Philip Lowe, stated that surging household debt levels has led the economy in a weaker position to deal with shocks.

Elsewhere, in China, Australia’s largest trading partner, the Caixin/Markit services PMI fell to a level of 51.5 in April, expanding at its weakest pace in eleven months, thus casting fresh doubts over the health of the nation’s economy. The PMI had registered a reading of 52.2 in the previous month.

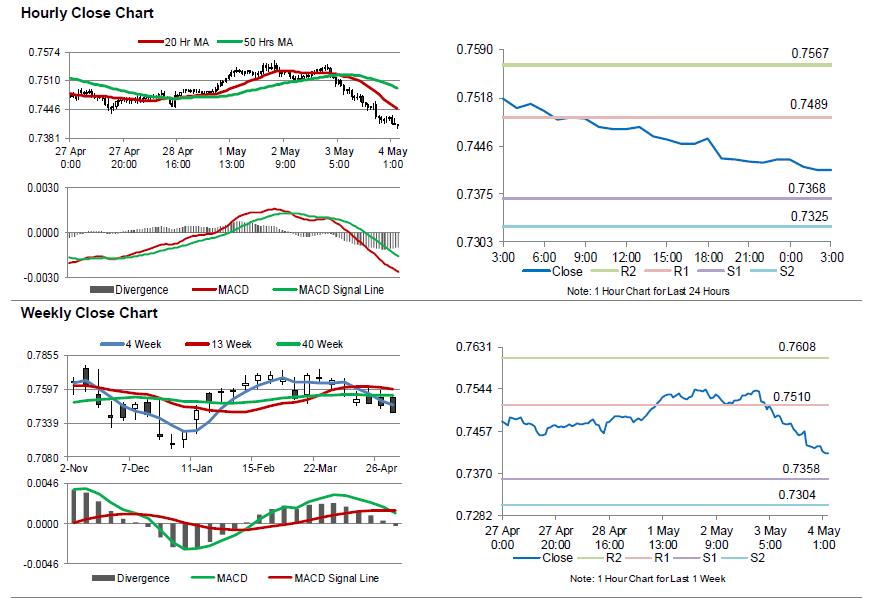

The pair is expected to find support at 0.7368, and a fall through could take it to the next support level of 0.7325. The pair is expected to find its first resistance at 0.7489, and a rise through could take it to the next resistance level of 0.7567.

Moving ahead, traders will keep a close watch on the RBA’s recent meeting statement coupled with Australia’s AiG performance of construction index for April, due to release overnight.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.