For the 24 hours to 23:00 GMT, the AUD rose 0.09% against the USD and closed at 0.7577.

LME Copper prices declined 1.34% or $31.0/MT to $2278.0/MT. Aluminium prices rose 0.01% or $1.0/MT to $7201.5/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7555, with the AUD trading 0.29% lower against the USD from yesterday’s close.

Overnight data indicated that Australia’s seasonally adjusted unemployment rate declined to 5.4% in May, hitting a 6-month low and suggesting that the nation’s labour market is strengthening. Markets were expecting unemployment rate to ease to 5.5%, after registering a reading of 5.6% in the previous month.

On the other hand, the nation’s consumer inflation expectations climbed to 4.2% in June, compared to a reading of 3.7% in the prior month.

Elsewhere, in China, Australia’s largest trading partner, retail sales rose to 8.5% on an annual basis in May, undershooting market consensus for a rise to 9.6%. In the previous month, retail sales had recorded an advance of 9.4%. Additionally, the nation’s industrial production expanded 6.8% on an annual basis in May, lower than market expectations for a gain of 7.0%. In the previous month, industrial production had advanced 7.0%.

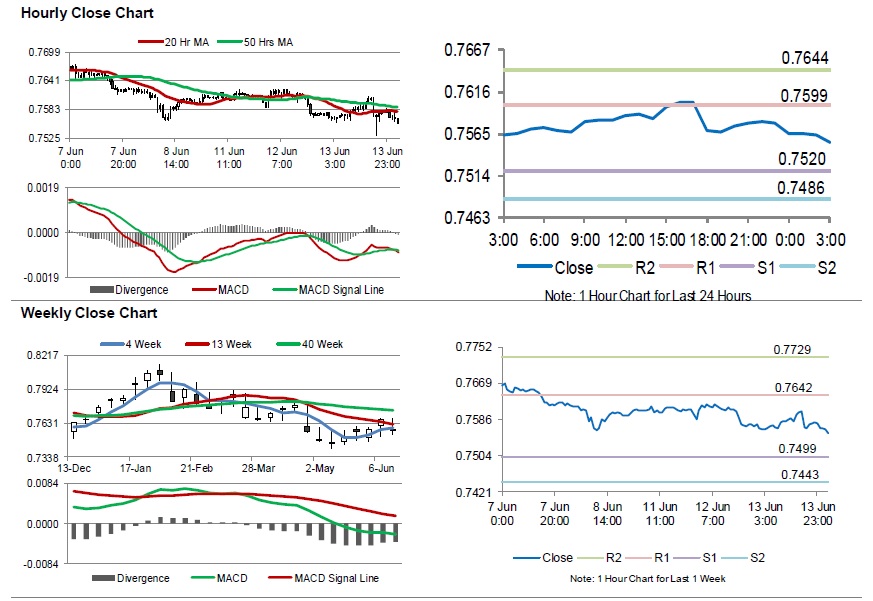

The pair is expected to find support at 0.7520, and a fall through could take it to the next support level of 0.7486. The pair is expected to find its first resistance at 0.7599, and a rise through could take it to the next resistance level of 0.7644.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.